Trading Procedure

Opening and Closing Price Calculation

Opening and Closing Price Calculation

By this method, the SET's trading system will randomly select a closing time between 16:35 – 16:40 hours. Therefore, members will have an extra period from 16:30 to the random closing time to place additional orders which will not be matched or executed until the random closing time. At the random closing time, SET calculates the closing price by the auction method, which is the same method for determining the opening price in the pre-open session. From all the valid orders in the system, the closing price will be determined from

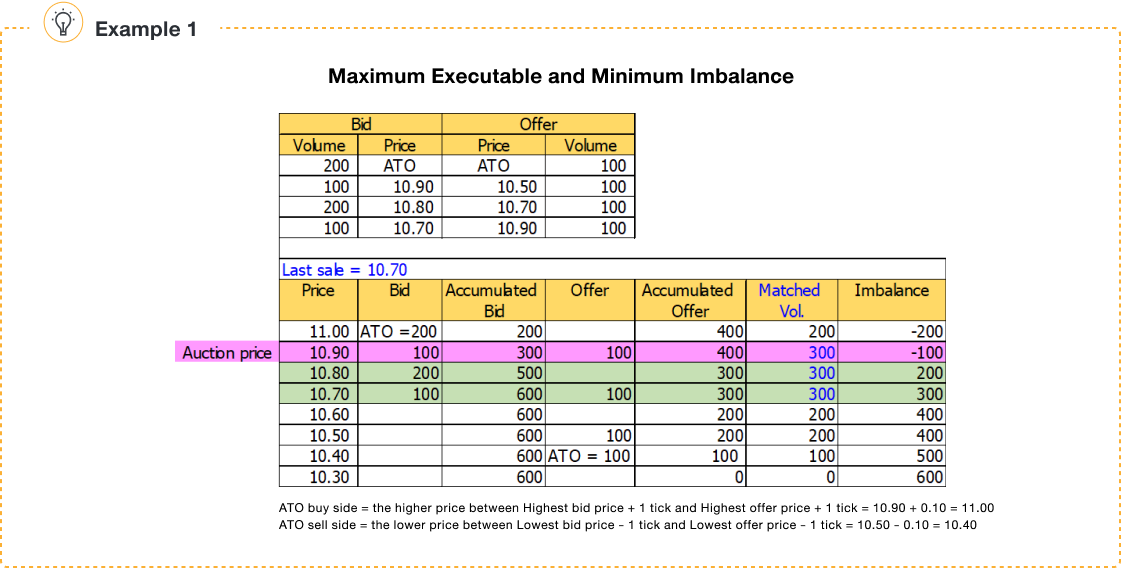

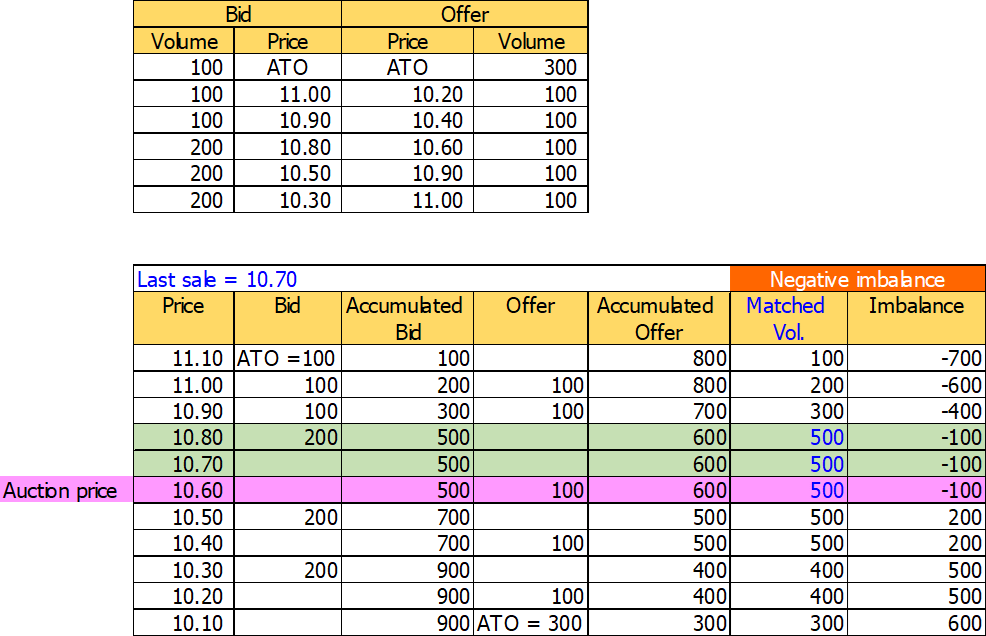

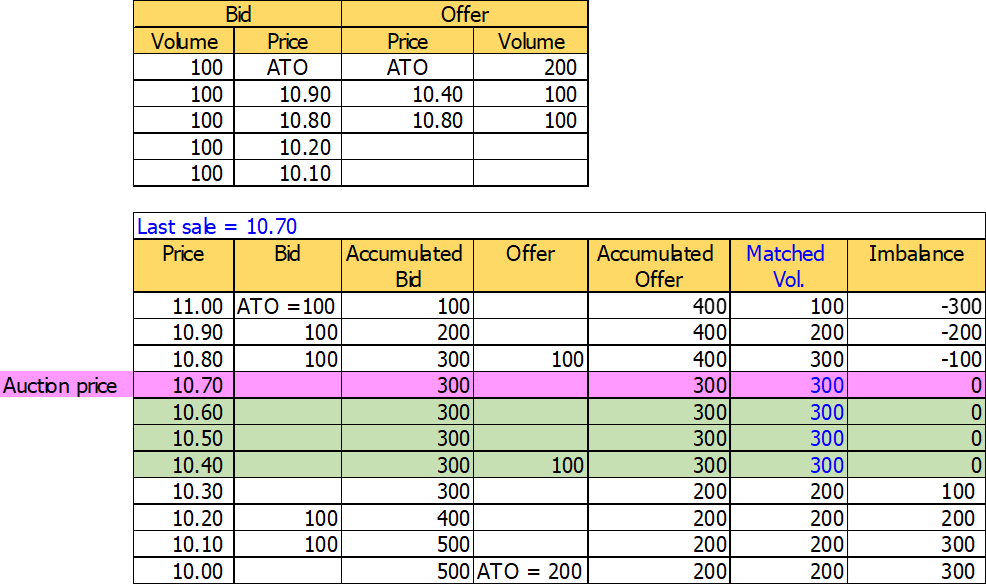

| (1) The price that generates the greatest executable volume. (2) If there is more than one such price at which there is maximum executable volume, the price with minimum unexecuted volume (“minimum imbalance” or “minimum order surplus”) will be chosen. (See Example 1) (3) If there is more than one price with minimum imbalance as described in (2) above, the market pressure on the side of the book with the minimum imbalance determines the execution price. |

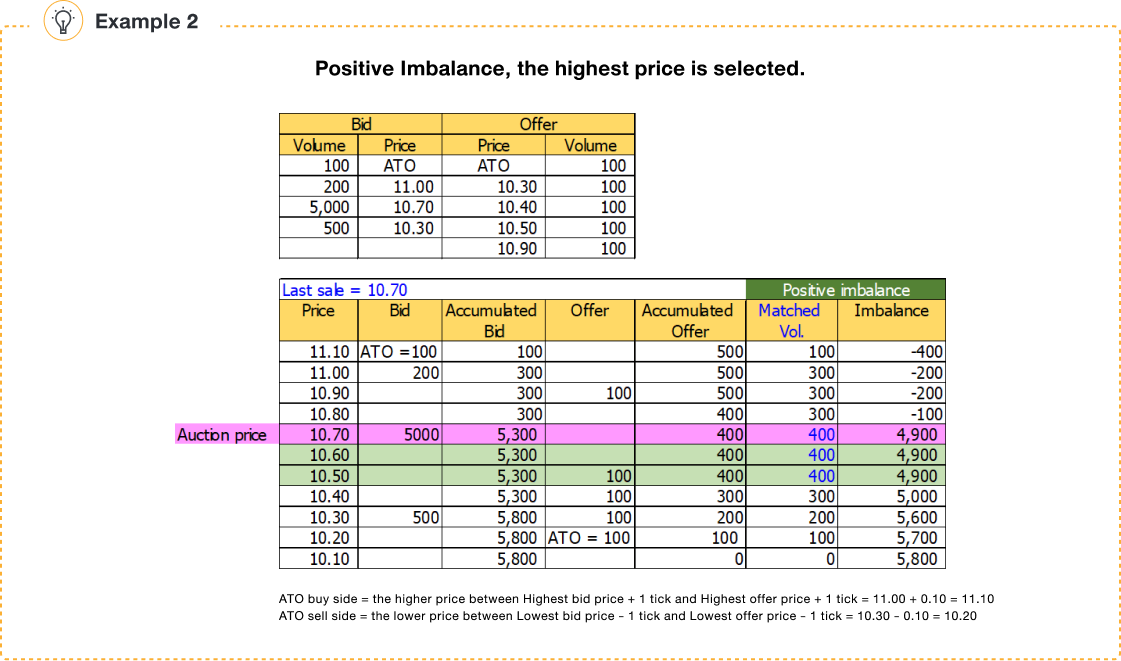

3.1 If all the imbalances are on the buy side, there is a greater demand to buy the security and prices are likely to go up. The higher of the possible limit prices is therefore used as the auction price. (See Example 2)

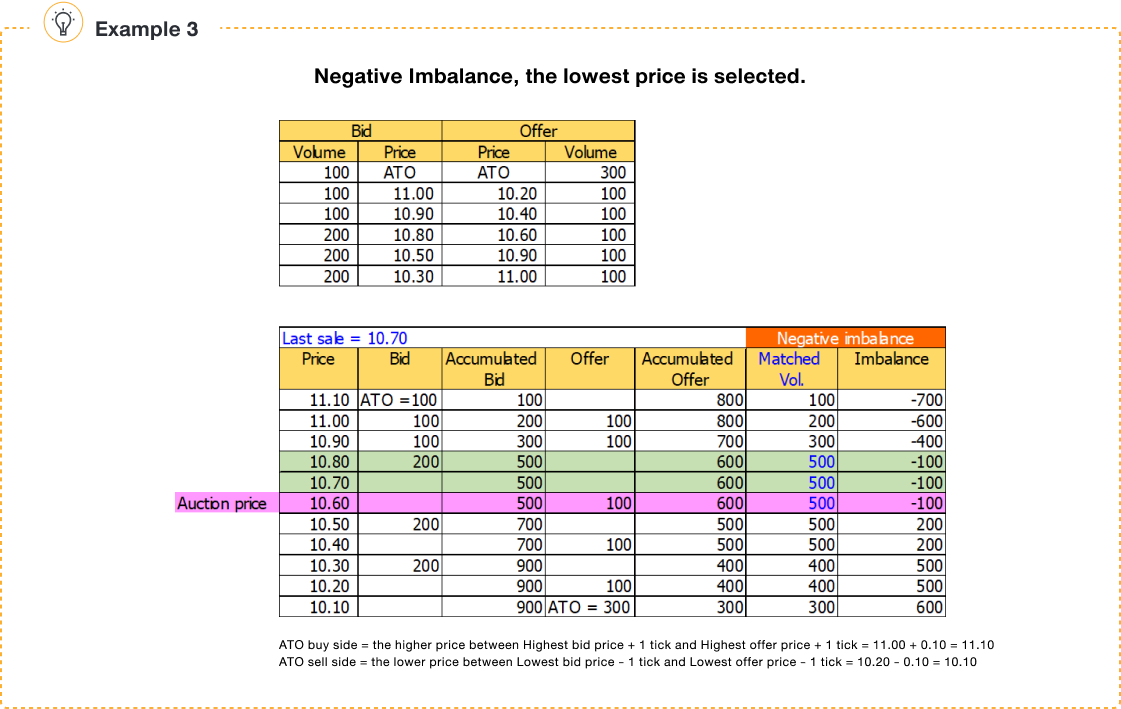

3.2 If all the imbalances are on the sell side, there is a greater demand to sell the security and prices are likely to go down. The lower of the possible limit prices is therefore used as the auction price. (See Example 3)

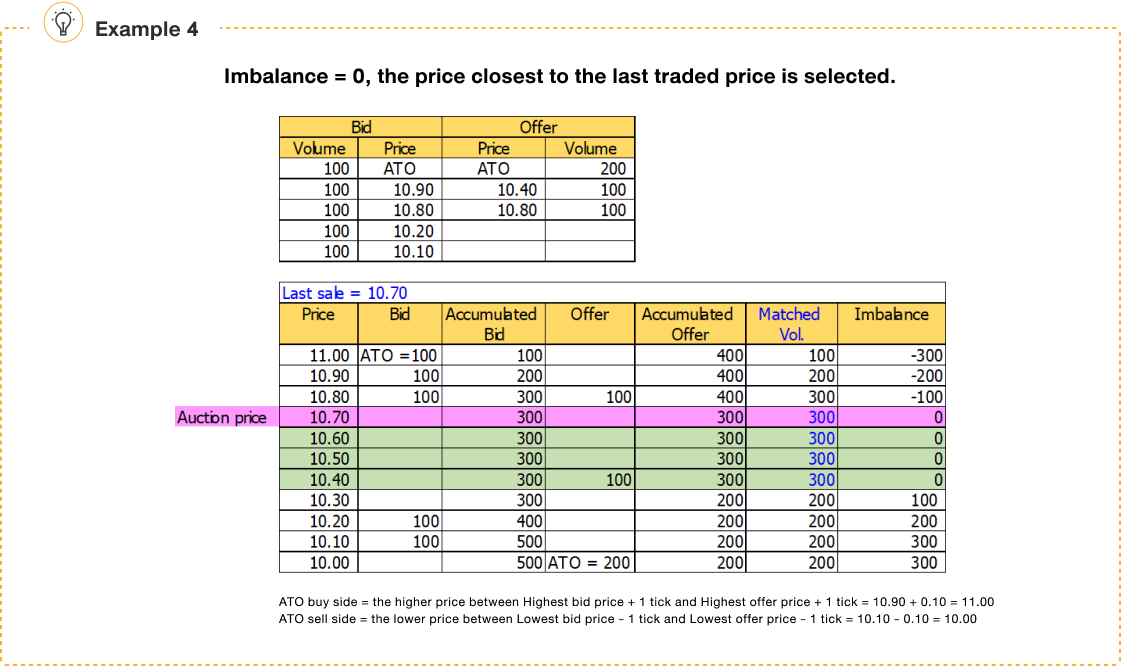

3.3 If the aggregate buy volume is equal to the aggregate sell volume in all price levels, price closest to the last trading price (Last Sale), IPO Price or the lowest price is selected respectively. (See Example 4)

Note: Since at-the-open (ATO) orders and at-the-close (ATC) orders contain first-matching priority over limit-price order, the system will determine the price of ATO and ATC orders as follows

If ATO/ATC as Bid |

If ATO/ATC as Offer |