Securities Clearing Services

Thailand Clearing House Company Limited

Securities Clearing Services

Securities Clearing Services

TCH has designated the following types of clearing members:

1. General Clearing Member (GCM) : a member who undertakes the Securities clearing and settlement for itself or clients, or for other members or other members’ clients.

2. Direct Clearing Member (DCM ): a member who undertakes the Securities clearing and settlement for itself or clients whereby the member’s clients must not be the members of SET or the members of TCH.

Have the shareholders’ equity according to the criteria prescribed by TCH

|

| Be a member of the Clearing Fund |

| Be a juristic person licensed to operate the businesses in the category of securities brokerage or securities dealing or other persons as prescribed by TCH |

| Have a net capital according to the criteria prescribed by the SEC Details click here |

| Be a securities depositor at a securities depository center Details click here |

Rights of a Member

TCH members have the rights to use the securities clearing and settlement services in TCH’s system as well as other services made available by TCH, provided TCH may render different services to the Members based on their membership categories

| Item | Fee |

| Admission fee | None |

| Monthly fee | THB15,000 |

| Other fees | Detail Click here |

| An applicant submits an application form and supporting documents | |

| TCH considers the application | |

| The applicant attends the TCH system training and test | |

| TCH notifies the applicant of the result of its consideration | |

| TCH notifies the applicant of the commencement date of its membership (once the applicant has fully complied with the criteria and has all qualifications required) | |

| The applicant makes a contribution to the Clearing Fund and submits documents required by TCH | |

| The applicant commences operation as a member |

Settlement Agent

TCH authorizes settlement agents to settle and deliver securities on behalf of its members. Settlement agents can be custodians, commercial banks, state-owned specialized banks, finance companies, or securities companies.

| Being a juristic person licensed to operate the following businesses: |

| Have the shareholders’ equity of not less than THB 150 million |

| Be a member of a depository center. Depository Membership Application Details click here |

| Item | Fee |

| Admission fee | None |

| Monthly fee | Details here |

| Pre-Settlement Matching Transaction Fee |

Securities Clearing and Settlement

Securities Clearing

and Settlement

| Net Settlement |

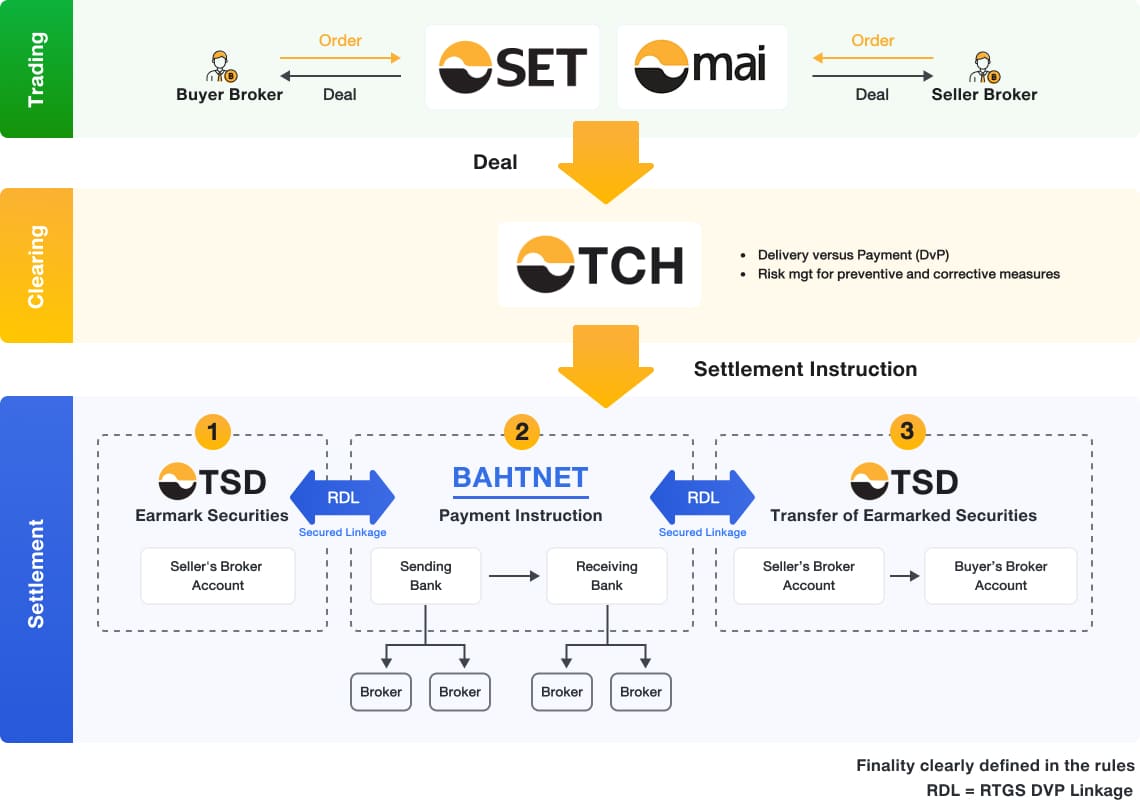

TCH applied the Delivery versus Payment (DvP) clearing and settlement method for securities traded on SET and mai, which requires payment for securities to be made at the same time the securities are delivered. The procedure is an international clearing and settlement standard recommended by the Group of 30, a collaboration of post-trading services organizations formed to develop a standardized operational approach.

The DvP method reduces risks to the clearing house, which acts as the securities clearing and settlement guarantor, builds confidence in the system, increases liquidity in the Thai capital market, supports cross-border transactions, reduces settlement time, and allows investors to use securities immediately. The clearing and settlement for equity securities must be carried out within the second business day after the trading day (T+2).

Net Settlement Procedure

Net Settlement

Procedure

Cash Clearing

TCH acts as an intermediary of cash clearing between buyers and sellers. There are 2 methods of the payment depending on the types of clearing members:

Securities Settlement

In terms of securities settlement, the TSD, as the appointed settlement agent, will transfer securities in the clearing member’s accounts using the book entry through the TSD’s securities depository system according to the information from TCH.

Clearing members must open a depository account (Portfolio Account)

separate from the accounts of the member's clients (Client Account) as specified by the Depository Center.

to separate the assets and obligations of members and clients. In case of defaulting on securities delivery, defaulting member will not be able to use the client’s securities for covering their own account.

| Gross Settlement |

Clearing members may specify the settlement date since trade date to the settlement date according to its settlement cycle of each security. General members have to create the gross transaction by referring to trade deal. Clearing and settlement will be processed on time of specified settlement date below:

Gross Settlement Procedure

Gross Settlement Procedure

TCH acts as a Central Counterparty (CCP) for buyer and seller members

As a counterparty, TCH is exposed to counterparty risks when its clearing members fail to meet their obligations, so it is critical for TCH to assess any potential financial risks and design an effective risk containment model and financial safeguards. TCH has consistently developed risk management policies and tools to mitigate the risks associated with securities clearing and settlement defaults.

Collateral requirements

1. The Early Warning System: A calculation of daily risk value in the clearing and settlement system of general members to determine the maximum damage value that could result from a change in securities prices. If a member's risk value exceeds TCH’s limit, the member must place collateral to cover the damages that may occur.

2. Settlement Cap: A limit on each member's clearing and settlement value based on the member's financial situation. If a member's Cumulative Settlement Value (CSV) exceeds the settlement cap, TCH will ask the member to place collateral.

3. Stress Test: TCH will ask members to place collateral if the damage value in a crisis situation exceeds the TCH's financial resources value to ensure sufficient financial resources to cover losses that may occur during the crisis.

Although TCH has three collateral call approaches, the actual collateral call value is the highest of the three, and members are required to place collateral by 11.00 hrs.

Assets Deposited as Collateral

The assets that members can deposit as collateral must be subject to low market risk, liquidity risk, and credit risk. TCH has determined the following assets as acceptable collateral to ensure that the collateral can be used to pay off debts or cover potential damages:

1. Cash in Thai Baht

2. Securities listed on the Stock Exchange, provided that they are not issued by the member who has placed the collateral or the member's group of companies unless they are securities for

which the member is obligated to deliver to TCH

3. Government bonds or Bank of Thailand bonds

| Transaction | Hours |

| 1. Securities clearing and settlement | |

| 1.1 Gross Clearing |

|

| 1.2 Net Clearing | |

| 1.2.1 Normal hours (Session 1) | |

| (1) Delivery of Securities |

|

| (2) Payment for Securities |

|

| 1.2.2 Session 2 | |

| (1) Delivery of Securities |

|

| (2) Payment for Securities |

|

| 1.3 TCH Buy-in | |

| 1.3.1 Delivery of Securities |

|

| 1.3.2 Payment for Securities |

|

| 2. Pre-Settlement Matching System (PSMS) | |

| 2.1 Creation of transaction | |

| 2.1.1 In the case that there is no conversion of Securities types / conversion of Securities types from Foreign to Local |

|

| 2.1.2 In the case that there is conversion of Securities types from Local to Foreign or from NVDR to Foreign |

|

| 2.2 Edit / Merger of transaction (Edit/Merge) |

|

| 2.3 Cancellation of transaction (Cancel) | |

| 2.3.1 Cancellation of unmatched transaction |

|

| 2.3.2 Cancellation of matched transaction |

|

| 2.4 De-Match of transaction (De-Match) |

|

| 3. Creation and confirmation of Gross Clearing & Settlement transaction | |

| Creation of transactions and confirmation by counterparties | |

| 3.1 Securities clearing and settlement on the creation date of transaction |

|

| 3.2 Securities clearing and settlement on the day after the creation date of transaction onwards |

|

| 4. Editing transaction | |

| before the Securities clearing and settlement is due | |

| 4.1 Editing trading account number / type of investors |

|

| 4.2 Editing type of Securities | |

| 4.2.1 Editing type of Securities |

|

| (1) Local to Foreign | |

| (2) NVDR to Foreign | |

| 4.2.2 Editing type of Securities |

|

| (1) Foreign to Local | |

| (2) Local to NVDR | |

| (3) NVDR to Local | |

| 4.2.3 Editing type of Securities |

|

| (1) Local to NVDR | |

| (2) NVDR to Local | |

| after the Securities clearing and settlement is due | |

| 4.3 Editing type of Securities |

|

| (1) Local to NVDR | |

| (2) NVDR to Local | |

| 5. Give up/ Take-up transactions |

|

| 6. SBL for Covered Fail | |

| 6.1 Securities borrowing | 13.30 hrs. or at the end of the business day |

| 6.2 Return of borrowed Securities | |

| 6.2.1 Return of borrowed Securities prior to the due date | |

| 6.2.1.1 Return of Securities from the depository account |

|

| 6.2.1.2 Return of Securities from the Securities on the current business day Normal hours for Securities clearing and settlement (session 1) |

|

| 6.2.1.3 Return of Securities from the Securities on the current business day Securities clearing and settlement session 2 |

|

| 6.2.2 Return of borrowed Securities on the due date |

|

| 6.2.3 Enforcement of collateral placed by the borrower by TCH |

|

| 6.3 Cash Settlement |

|

| 7. Default and delivery of defaulted Securities | |

| 7.1 Default and delivery of defaulted Securities |

|

| 7.2 Delivery of defaulted Securities | |

| 7.2.1 Delivery of defaulted Securities by clearing for transfer Securities from the depository account of the defaulting Member or the defaulting client of the Member |

|

| 7.2.2 Delivery of defaulted Securities by clearing for transfer Securities which the defaulting Member or the defaulting client of the Member is entitled to receive on the current business day | |

| (1) Normal session for Securities clearing and settlement (session 1) |

|

| (2) Securities clearing and settlement session 2 |

|

| 7.2.3 Automatic delivery of defaulted Securities by maintaining the Securities in the defaulted account |

|

| 7.3 Cash Settlement |

|

| 8. Buy-in transaction | |

| 8.1 Creation of offer in the clearing system |

|

| 8.2 Submission of Securities sale order from the trading system |

|

| 9. Placement or return of collateral as a result (1) default in payment (2) delivery of Securities borrowing (3) lending for the purpose of delivery to TCH * | |

| 9.1 Placement of collateral in cash |

|

| 9.2 Return of collateral in cash |

|

| 9.3 Placement of Securities as collateral | |

| 9.3.1 In the case of default in payment for Securities, default in delivery of Securities, and default in Securities borrowing and lending for the purpose of delivery to TCH |

|

| 9.3.2 In the case of placement of additional collateral or return of excess collateral in the form of Securities as a result of calculation of Mark to Market. |

|

| 10. Deposit and withdrawal of collateral of Risk Value * | |

| 10.1 Deposit of collateral | |

| 10.1.1 Deposit of Non-cash collateral by Members |

|

| 10.1.2 TCH Deduction of cash in Thai Baht currency from the Settlement Account by TCH as collateral |

|

| 10.2 Withdrawal of collateral, both cash in Thai Baht currency and non-cash | |

| 10.2.1 The Member withdraws collateral in cash in Thai Baht currency |

|

| 10.2.2 The Member receives collateral in cash in Thai Baht currency in the Settlement Account |

|

| 10.2.3 The Member withdraws non-cash collateral |

|

| 10.2.4 The Member receives non- cash collateral |

|

General member 15,000 baht |

Settlement agent 7,500 baht |

0.001 % of trading value, maximum of 350 baht/trading order

| Clearing and Settlement Transaction on behalf of Member | Tier | Amount of Transaction Per Month | Rate (THB per Transaction) |

| 1. Clearing to Custodian transactions which consist of | |||

| 1 | 0 – 5,000 | 50 | |

| 1.1 transaction between TCH member and Settlement Agent; | 2 | 5,001 – 10,000 | 45 |

| 1.2 transaction between Settlement Agents themselves. | 3 | 10,001 – 15,000 | 40 |

| 4 | >15,001 | 35 | |

| 2. Transaction within Settlement Agent (Internalized) | |||

| 2.1 transaction for settlement purpose for the same client | Exempted | ||

| 2.2 transaction for settlement purpose for different clients | 7.50 |

| 3.1 For any delay of payments due to human errors without causing damages to securities clearing and settlement and delivery system | |

| First default in one calendar year: | 5,000 Baht |

| Second default in one calendar year: | 10,000 Baht |

| Third default or more in one a calendar year: | 50,000 Baht |

| 3.2 If members have default for cash payment the stipulated time | |

| General members: no more than 2 times of the defaulting value | |

| 4.1 In case of late delivery due to human errors | |

| Second time in one calendar year: | 2,000 baht |

| Third time or more in one calendar year: | 5,000 baht |

| 4.2 Late delivery | |

| General members | |

| Late delivery no more than 1 business day: | 0.50% of the value of defaulted securities |

| Late delivery from 1 to 2 business days: | 0.75% of the value of defaulted securities |

| Late delivery from 2 to 3 business days: | 1.00% of the value of defaulted securities |

| Late delivery from 3 to 4 business days: | 1.75% of the value of defaulted securities |

| * Such penalties must not be less than 300 baht per securities at a time | |

Related Information

The Thailand Clearing House Co. Ltd.

The Stock Exchange of Thailand Building 93 Ratchadaphisek Road, Din Daeng, Bangkok 10400

Open : Mon - Fri 08:30 - 17:00

| Member Corner (SET Portal) Equity & Debt Member |  |

| login |

| Member Corner (SET Portal) Equity & Debt Member |  |

| login |

.jpg)