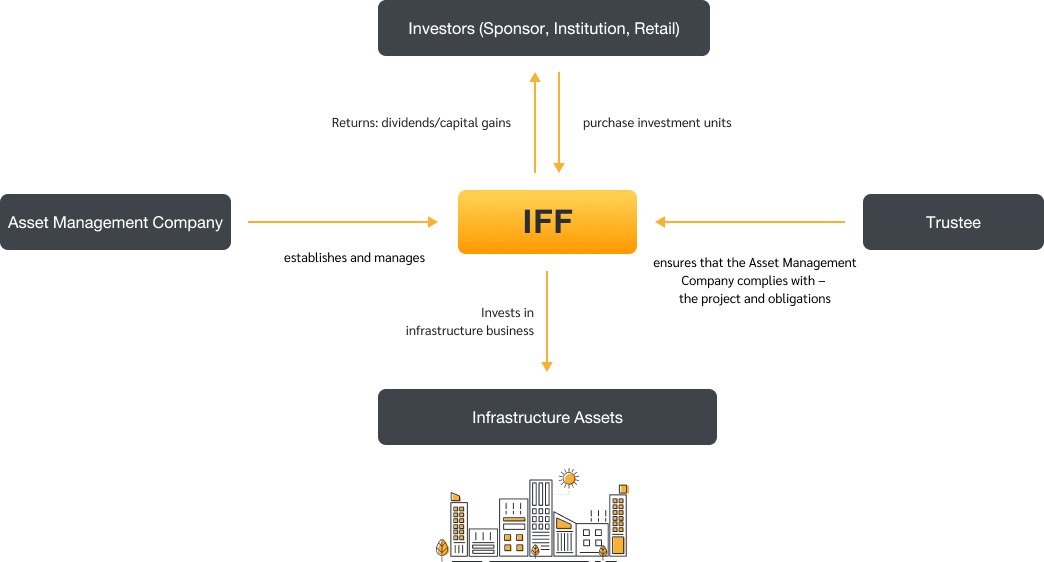

IFF: Infrastructure Fund

A mutual fund established to raise funds from general investors including retail and institutional investors, with proceeds going toward infrastructure projects that benefit the public on a large scale and are vital to Thailand's economic growth and development.

A mutual fund established to raise funds from general investors including retail and institutional investors, with proceeds going toward infrastructure projects that benefit the public on a large scale and are vital to Thailand's economic growth and development.

A fundraising alternative for public and private sectors

Through IFFs, both public and private sectors can use their revenue-generating infrastructure businesses to raise funds from investors and use the proceeds to develop new large-scale projects, which require substantial investment.

For government agencies

IFFs can reduce restrictions on government agencies' budget and public debts because the country still needs more necessary infrastructure projects.

For investors

IFFs increase investment options and opportunities in the country's infrastructure assets while also providing 10 years dividend tax exemption for retail investors.

An IFF can choose to invest in the following types of infrastructure business:

Direct investment through an ownership in the assets: suitable for infrastructure assets with transferable ownership such as assets of private entities |

Investment in revenue sharing agreement or leasehold: suitable for public assets with non-transferable ownership/ concession |

Investment in companies operating infrastructure business |

An IFF can choose to invest in the following types of infrastructure business:

Direct investment through an ownership in the assets: suitable for infrastructure assets with transferable ownership such as assets of private entities |

Investment in revenue sharing agreement or leasehold: suitable for public assets with non-transferable ownership/ concession |

Investment in companies operating infrastructure business |

Railway or pipeline transportation |

Airports/ Airfields / Deep seaports |

Roads/expressways/concession ways |

Alternative energy |

A Multi-infrastructure project which includes multiple infrastructure assets |

Waterworks /Electricity generation |

Water management system and irrigation system Waste management system |

Natural disaster prevention system |

Natural disaster prevention, warning, and management system |

Telecommunication, or infrastructure for Information Technology and Communication |

| Type of fund | An IFF is a close-ended fund with non-redeemable units (1). The fund's name must begin with "Infrastructure Fund," followed by words describing the types of infrastructure activities the IFF invests in. |

| Registered capital | At least THB 2,000 million |

| Unit Types |

|

| Investment in infrastructure assets |

|

| Number of unit holders after IPO | Not less than 500 Except in case of funds having policy to invest in in Greenfield Projects more than 30% of the total asset value of such funds, there must be at least 35 high net-worth investors (4) |

| Listing | SET

|

| Dividend payment | ≥ 90% of adjusted net profit |

Remarks

(1) Except in case of buy-back of the units specifically described in the project which the asset management company is able to demonstrate that such buy-back will not impact the fund's viability

(2) A completed project refers to an infrastructure business which has completed the construction and has begun to generate revenue

(3) An incomplete project refers to an infrastructure business which has not yet begun construction, is under construction, or has completed the construction but has not yet begun to generate revenue

(4) A high net-worth investor refers to someone who makes an initial unit purchase of at least THB10 million or whose total unit value, including additionally acquired and existing units, is at least THB10 million. The value of such investment units must be calculated based on the trading value at the time of purchase.

Remarks

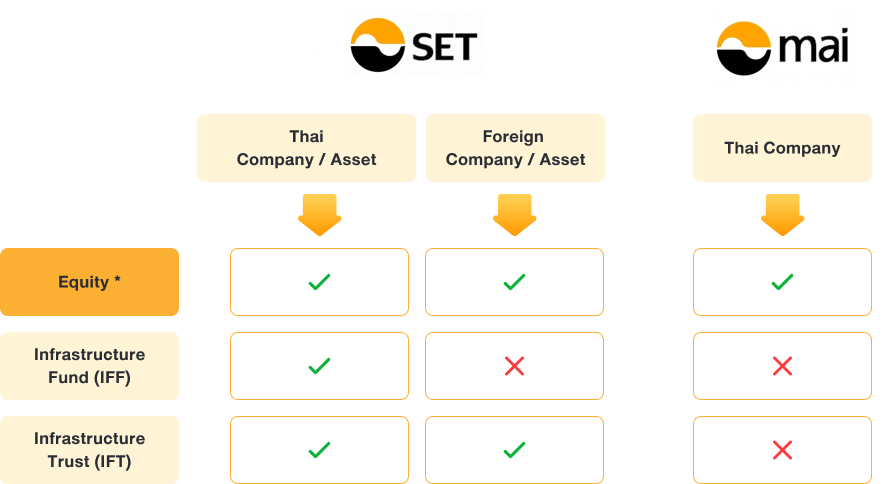

* Fundraising in a form of company including:

1) Company with general business operation;

2) Company whose main business is to hold shares (Holding company); and

3) Company investing in infrastructure project (Infrastructure company)

| Infrastructure Fund | Infrastructure Trust | |

| Structure | Mutual Fund | Trust |

| Investment | Infrastructure that benefits the public on a large scale in Thailand | Infrastructure that benefits the public on a large scale in Thailand or abroad |

| Project valuation | ≥ THB 2,000 million | ≥ THB 10,000 million |

| Tax privileges | Tax privileges (up to 10 years dividend tax exemption for individuals) | No tax benefits privilege |

Listing of Infrastructure Fund on SET

Besides listing on the SET, an infrastructure company may utilize its assets in raising fund in the form of infrastructure fund (Infra Fund). Setting up a mutual fund needs to get permission from the SEC and get the investment units listed on SET in accordance with SEC regulations. Qualifications of the fund and its units are as follows:

- Be fully paid

- Holding bearer’s name

- No restrictions on transferring the trust units, except for the legal restrictions. Such restrictions must be stated in the project.

- An infrastructure fund can invest in the infrastructure businesses, which refer to the following businesses as per SEC rule:

- Rail or pipeline transportation

- Electricity

- Waterworks

- Roads, special path, or commissioned path

- Airports

- Deep water port

- Telecommunication or ICT Infrastructure

- Alternative energy

- Water management or irrigation systems

- Natural disaster protection systems including the warning system and disaster mitigation system

- Waste management system

- Multi-infrastructure business comprising of complementary facilities, which are:

- Connected, or promoting mutual benefits, or beneficial to the community or its neighborhood; and

- Generating or having income contribution for no less than 80% of the composite revenue

- Infra fund going to list on SET must have the following qualifications:

- Approved by SEC

- Having a fund manager approved by the SEC

- Having a minor holders of investment units in an aggregate number of no less than 20% of the number of each tranche

Appointing Thailand Securities Depository Co., Ltd. (TSD) or other SET-approved persons to act as securities registrar

- Fund management firm submits the listing request

- Requesting listing for all issued fund units

- Submitting the request, required documents, and application fee to SET

The SET will consider listing request within seven days upon receiving complete and correct documents

Process of Listing Consideration for an Infrastructure Fund

1. Periodic Information Disclosure

| Required disclosure | Deadline* | Detail |

Annual financial statements (audited)

| Within 2 months Within 3 months | Required submission to SET:

|

| Quarterly financial statements (reviewed) | Within 45 days | |

| Form 56-REIT1 | Within 3 months | |

| Annual reports | Within 4 months |

| Required disclosure/submission | Disclosure/submission deadline |

| 1) Disclosures to investors for informational purpose | |

| Asset values, net asset values and values of investment unit | Within 45 days from the end of each quarter* |

| Summaries of Q&A with unitholders during two-way communication sessions | Within 14 days from the completion date of each two-way communication session* |

| Progress reports on pre-completion infrastructure projects under funds’ investment | Every 6 months from the date of investment in such principal assets. The reports shall be disclosed within 30 days from the end of the 6-month period* |

| 2) Submission to SET for information | |

| Reports on the number of minority unitholders | Within 120 days from the end of accounting period |

| Notices of unitholder meetings or two-way communication sessions | Concurrent with the submission of the notices to the unitholders |

| Minutes of unitholder meetings | Within 14 days from the unitholder meetings |

2. Material events disclosure

| Required disclosure | Disclosure time frame |

| 2.1) Information related to fund operations or information potentially affecting trading prices of fund units, or investment decisions or benefits of unitholders | |

| Immediately |

| 2.2) Information not having direct impact but warranting disclosure to investors | |

| Within 3 working days |

| 2.3) Disclosure of book closing dates (BC) or record dates (RD) | |

| ≥ 14 days prior to BC or RD |

| ≥ 7 days prior to BC or RD previously disclosed |

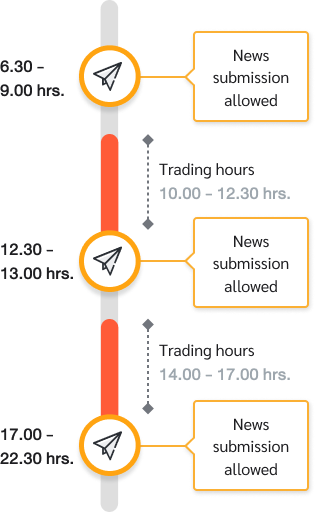

- Disclosure and submission of information in both Thai and English must be made via SETPortal.

- For material information requiring immediate disclosure, such disclosure must be made without delay on the event date or, at the latest, before the first trading session on the next business day.

Time interval for information disclosure via SETPortal

- Investment units failing to meet any of the following requirements:

- Being fully paid-up

- Bearing holders’ names

- Having no restrictions on transfer of investment units

- Having SEC-approved fund schemes

- Having SEC-approved fund managers

- Management companies demonstrate violation of or non-compliance with SET’s regulations which may severely affect the rights and benefits of investors, investor decisions, or investment unit price movement.

- Management companies disclose false information or omit disclosure of material information which may severely affect the rights and benefits of investors, investor decisions, or investment unit price movement.

- Trading in the investment units has been suspended (SP designation) for more than 2 consecutive years due to funds’ violation of or non-compliance with SET’s regulations.

- Auditor’s disclaimer of opinion on the annual financial statements for 3 consecutive years.

- Mutual funds reach their maturity.

- Mutual funds dissolve on grounds prescribed under the SEC notifications.

Related Regulations

|

|

|

|

|

|

|

|

Forms

|

Related informations