- REIT is a financial instrument that real estate operators or property owners can use to create an optimal fund-raising structure for the purpose of investment and new project development

- REIT is established to raise funds from general investors including retail and institutional investors who invest in high-potential real estate

- REIT brings the fundraising through real estates in a property fund up to international standards, increasing flexibility in fundraising through management by debt financing experts, and supporting the long-term growth of the Thai real estate industry.

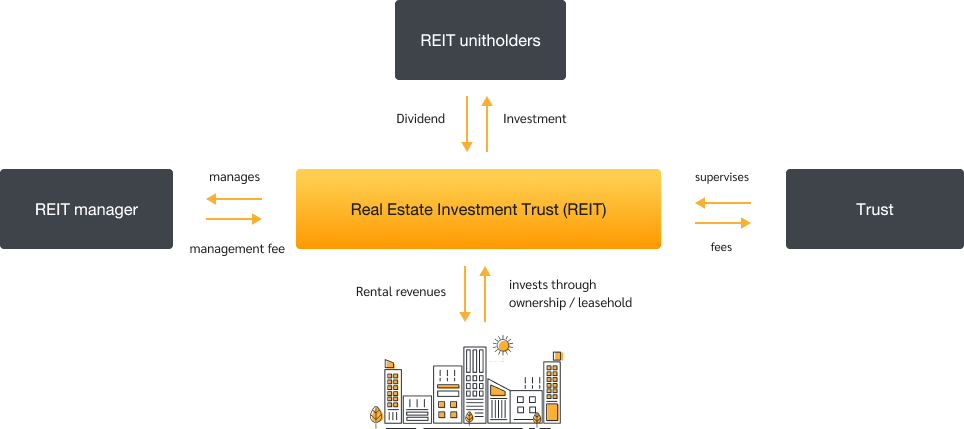

- REIT raises funds from investors to invest in real estate which generates regular revenue in a form of rent. REIT may acquire ownership in real estate (freehold) or invest in leasehold and then lease such real estate so that REIT can generate regular revenue from rent and pay dividends to investors. The trust manager is the person responsible for managing the trust so that it generates returns for shareholders.

Business operators |

A fundraising alternative that uses real estate which generate returns in a form of rent to raise funds from investors to further invest and develop new projects.

Investors |

- Enjoy long-term returns and low price fluctuation

- Able to invest in a wider range of real estates managed by real estate investment and management experts

- No need to inject large investment as is normally required in a direct investment in real estate

- Receive 90% of the adjusted net profit

Business operators |

A fundraising alternative that uses real estate which generate returns in a form of rent to raise funds from investors to further invest and develop new projects.

Investors |

- Enjoy long-term returns and low price fluctuation

- Able to invest in a wider range of real estates managed by real estate investment and management experts

- No need to inject large investment as is normally required in a direct investment in real estate

- Receive 90% of the adjusted net profit

|  |

All types of real estates such as office buildings, shopping centers, and warehouses,. However, there must be no disputes that have a significant impact on utilization of the real estate |

Real estate located in the country and/or abroad |

Real estate which is ready to produce benefits of ≥ 75% of the value of the total unit offered including loan proceeds (if any). The excess can be used to invest in other assets such as government bonds and bank deposits |

Real estate under construction. The investment to be used to develop the real estate until completion must not exceed 10% of the trust's total asset value and must be able to show that there is sufficient working capital for the development without jeopardizing the trust's viability |

The acquired real estate must have a total value of at not less than THB 500 million |

The REIT which leases real estate to anyone suspected of using it for unethical or illegal business |

All types of real estates such as office buildings, shopping centers, and warehouses,. However, there must be no disputes that have a significant impact on utilization of the real estate |

Real estate located in the country and/or abroad |

Real estate which is ready to produce benefits of ≥ 75% of the value of the total unit offered including loan proceeds (if any). The excess can be used to invest in other assets such as government bonds and bank deposits |

Real estate under construction. The investment to be used to develop the real estate until completion must not exceed 10% of the trust's total asset value and must be able to show that there is sufficient working capital for the development without jeopardizing the trust's viability |

The acquired real estate must have a total value of at not less than THB 500 million |

The REIT which leases real estate to anyone suspected of using it for unethical or illegal business |

| Establishment | The REIT trust deed/draft trust deed must comply with the Trust for Transactions in Capital Markets Act B.E. 2550 and the SEC's related notifications The name of the REIT shall reflect key characteristics and investment policy of the trusts |

| Size | The paid-up capital after the units offering is ≥ THB 500 million to support the required investment |

| Types |

|

| Investments |

|

| Obtaining Benefits |

|

| Benefits paid to trust unitholders | ≥ 90% of adjusted net profit |

| Debt financing and creation of encumbrance |

|

| Number of unitholders after IPO | ≥ 250 |

| Trading | Must be listed on the SET |

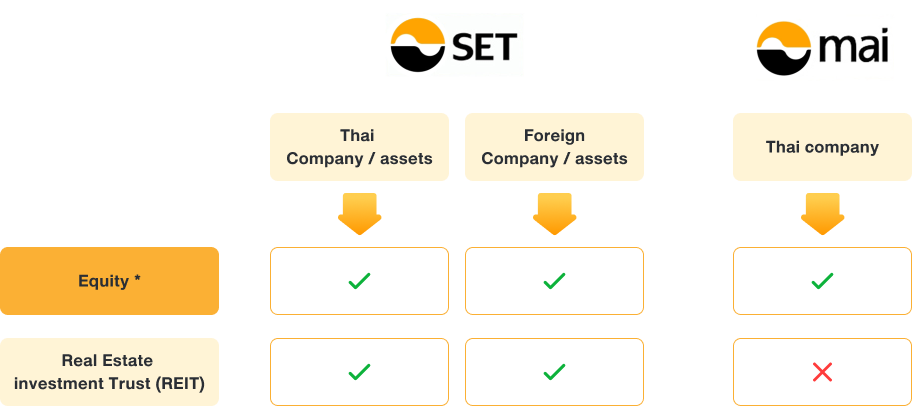

Remarks:

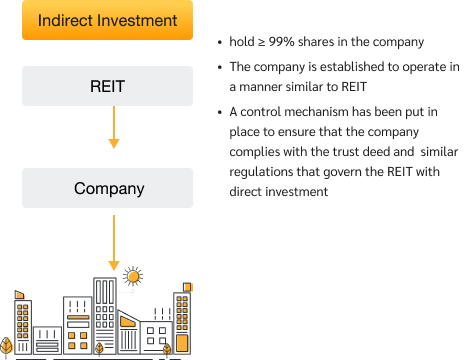

* Fundraising in a form of company including:

1) Company with general business operation;

2) Company whose main business is to hold shares (Holding company); and

3) Company investing in infrastructure project (Infrastructure company)

Listing of Real Estate Investment Trust (REIT) on SET

A type of fundraising as Real Estate Investment Trust (REIT) must seek approval from the SEC and get the trust units listed on SET. According to SEC rules, the qualifications of trust units, REIT units, and how to apply for SET listing are as follows:

Trust unit refers to the trust certificate that bears entitlement of the holder in receiving benefits from trust as specified by SEC rules.

- Be fully paid

- Holding bearer’s name

- No restrictions on transferring the trust units, except the legal restrictions. Such restrictions must be stated in the trust deed.

REIT refers to the trust for investing in property as per SEC rules. REITs have to be:

- Approved by SEC

- Having the SEC-approved trust manager and SEC-licensed trustee

- Having minority unitholders holding unit in an aggregate number of no less than 20% of the number of each tranche

Appointing Thailand Securities Depository Co., Ltd. (TSD) or other SET-approved persons to act as securities registrar

- The trust founder (person who is going to be the trust manager when a trust is founded) submits listing application

- Requesting listing for all issued trust units

- Submitting the request and required documents, plus paying fee, to SET

- The SET will consider listing request within seven days upon receiving complete and correct information

Process of Trust Unit Listing Consideration

Remarks :

- The applicant can be the trust founder, who is going to be the trust manager, or the trust manager specified in the trust deed as authorized person for submitting the listing application.

- The applicant can submit the draft filing, draft trust deed, and Kor documents, to SET, so that SET could consider the listing along with SEC’s process

1. Periodic Information Disclosure

| Required disclosure | Deadline* | Detail |

Annual financial statements (audited)

| Within 2 months Within 3 months | Required submission to SET:

|

| Quarterly financial statements (reviewed) | Within 45 days | |

| Form 56-REIT | Within 3 months | |

| Annual reports | Within 4 months |

| Required disclosure/submission | Disclosure/submission deadline |

| 1) Disclosures to investors for informational purpose | |

| Asset values, net asset values and values of unit trusts | Within 45 days from the end of each quarter* |

| Summaries of Q&A with unitholders during two-way communication sessions | Within 14 days from the completion date of each two-way communication session* |

| Progress reports on pre-completion real estate projects under trusts’ investment | Every 6 months from the date of investment in such principal assets. The reports shall be disclosed within 30 days from the end of the 6-month period* |

| 2) Submission to SET for information | |

| Reports on the number of minority unitholders | Within 120 days from the end of accounting period |

| Notices of unitholder meetings or two-way communication sessions | Concurrent with the submission of the notices to the unitholders |

| Minutes of unitholder meetings | Within 14 days from the unitholder meetings |

2. Material events disclosure

| Required disclosure | Disclosure time frame |

| 2.1) Information related to trust operations or information potentially affecting trading prices of trust units, or investment decisions or benefits of unitholders | |

| Immediately |

| 2.2) Information not having direct impact but warranting disclosure to investors | |

| Within 3 working days |

| 2.3) Disclosure of book closing dates (BC) or record dates (RD) | |

| ≥ 14 days prior to BC or RD |

| ≥ 7 days prior to BC or RD previously disclosed |

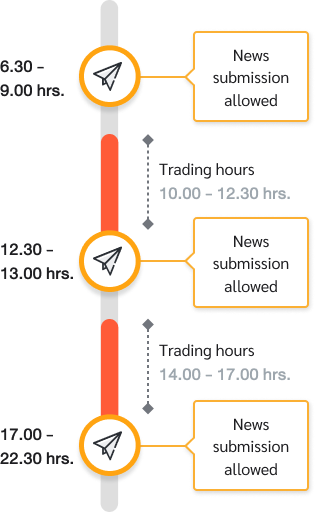

- Disclosure and submission of information in both Thai and English must be made via SETPortal.

- For material information requiring immediate disclosure, such disclosure must be made without delay on the event date or, at the latest, before the first trading session on the next business day.

Time interval for information disclosure via SETPortal

- Trust units or trusts failing to meet any of the following requirements:

- Being fully paid-up

- Bearing holders’ names

- Having no restrictions on transfer of trust units

- Being SEC-authorized trusts

- Having SEC-approved trust managers

- Having SEC-authorized trustees

- Trusts demonstrate violation of or non-compliance with SET’s regulations which may severely affect the rights and benefits of investors, investor decisions, or trust unit price movement.

- Trusts disclose false information or omit disclosure of material information which may severely affect the rights and benefits of investors, investor decisions, or trust unit price movement.

- Trading in trust units has been suspended (SP designation) for more than 2 consecutive years due to trusts’ violation of or non-compliance with SET’s regulations.

- Auditor’s disclaimer of opinion on the annual financial statements for 3 consecutive years.

- Trusts dissolve on grounds prescribed under the SEC notifications or trust deeds

Q&As

The trust deed and filing form must contain the following messages stating that the trust units are:

- Fully paid

- Bearer’s name

- Have no restriction in transferring the trust units, exception for the legal restrictions

Related Regulations

|

|

|

|

|

|

|

|

|

Forms

|

|

Related informations