- Ordinary shareholders’ meeting: In line with the Public Company Act, the listed company must hold its ordinary shareholders’ meeting every year and within four months after its accounting periods ends.

- Extraordinary shareholders’ meeting: The listed company will have to hold an extraordinary shareholders’ meeting when there is a significant agenda to propose to shareholders in the period other than ordinary meeting. For example, a listed company held its shareholders’ meeting in April 2018. Then, again in June 2018, it is necessary to gain approval from the shareholders in order to proceed. Therefore, an extraordinary shareholders’ meeting must be held.

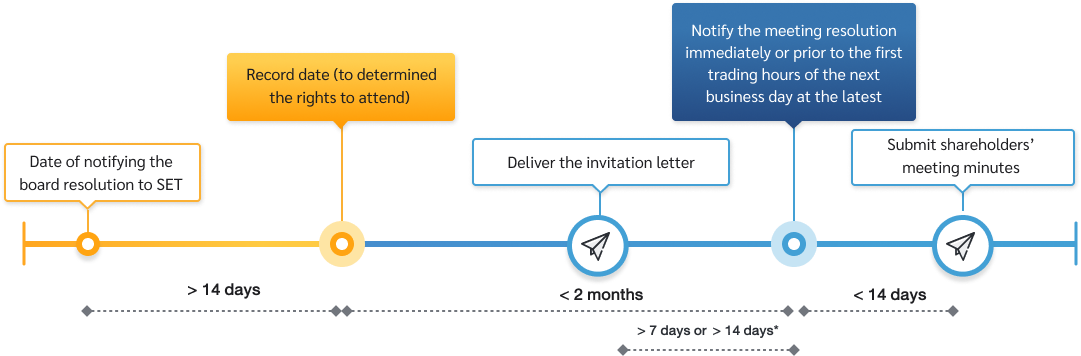

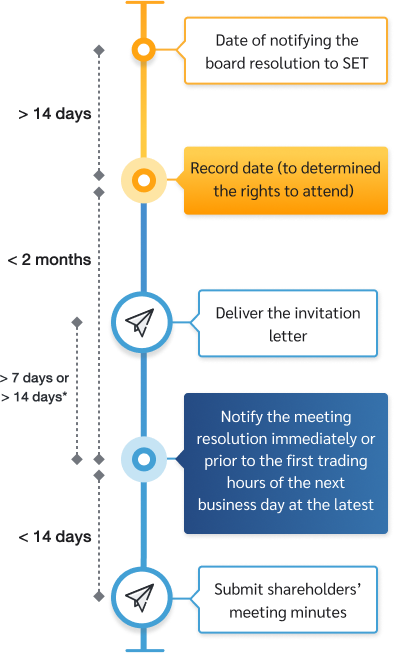

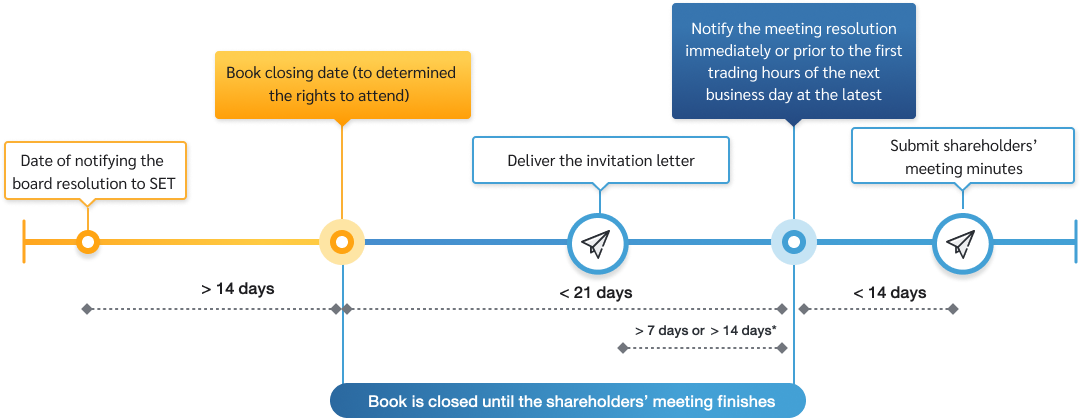

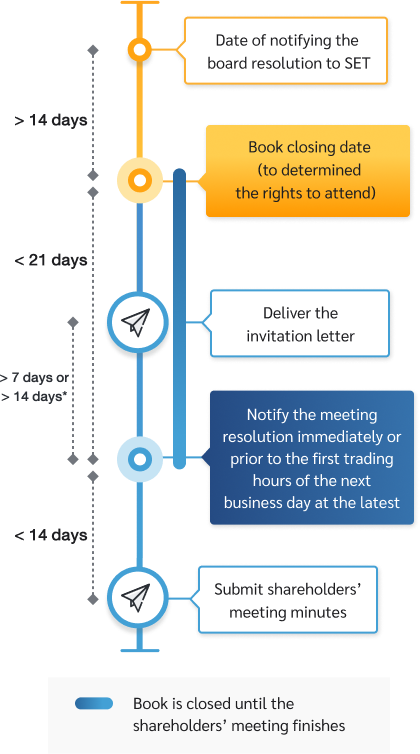

- The listed company’s board of directors will determine the date for shareholders’ meeting as well as the record date (RD) or book-closing date (BC). This date may also entitle shareholder’s rights, such as dividend payment or shares from capital increase.

- To determine the record date or book closing date, the listed company must notify its shareholders ≥ 14 days in advance of the record date or book closing date.

The listed company has to inform investors by announcing via SETLink the board’s resolutions on shareholders’ meeting, agenda, and record date immediately on the day the board had made the resolutions or prior to the first trading hours of the next business day at the latest. |

The listed company has to inform investors by announcing via SETLink the board’s resolutions on shareholders’ meeting, agenda, and record date immediately on the day the board had made the resolutions or prior to the first trading hours of the next business day at the latest. |

Significant information of the board’s resolutions are:

|

Significant information of the board’s resolutions are:

|

| Consideration at ordinary annual meeting | Extraordinary meeting |

|

|

|

|

|

|

| |

| |

| |

| |

|

In case there is an addition, removal, or change of significant meeting agenda, the listed company must notify SET ≥ 14 in advance of the record or book closing date.

Delivery period Delivering an invitation letter to shareholders’ meeting should consider the following:

|

Delivery period Delivering an invitation letter to shareholders’ meeting should consider the following:

|

| The listed company shall deliver a copy of invitation letter sent to shareholders as information to SET via SETLink. |

| The listed company shall deliver a copy of invitation letter sent to shareholders as information to SET via SETLink. |

| In the event that the shareholders are foreigners, the invitation letter should be in English as well |

| In the event that the shareholders are foreigners, the invitation letter should be in English as well |

Information to be displayed in the meeting invitation letter:

|

Information to be displayed in the meeting invitation letter:

|

Within the meeting date or prior to the first trading hours of the next business day at the latest, via SETLink to inform investors.

Within 14 days from the shareholders’ meeting date (for both ordinary and extraordinary shareholders’ meeting) via SETLink as information for SET

- To be perfectly prepared for the shareholders’ meeting, please study the AGM Checklist (on Thai Investors’ Association, or TIA, website at http://www.thaiinvestors.com). The TIA, Listed Company Association, and the Securities and Exchange Commission have cooperated to produce a handbook for listed companies to assess the quality of their shareholders’ meeting.

- To comply with the good governance principle on shareholders’ rights, before the management will hold the board meeting to determine agendas at the shareholders’ meeting the following year, the management can notify shareholders in advance via SETLink, so as to include shareholders in proposing the agenda and nominating the board members to the management to consider.

- The listed company may notify shareholders via SETLink that they have disseminated the invitation letter along with the annex on the company’s website, so as to provide the shareholders sufficient time to consider the agenda and related documents.

- To be perfectly prepared for the shareholders’ meeting, please study the AGM Checklist (on Thai Investors’ Association, or TIA, website at http://www.thaiinvestors.com). The TIA, Listed Company Association, and the Securities and Exchange Commission have cooperated to produce a handbook for listed companies to assess the quality of their shareholders’ meeting.

- To comply with the good governance principle on shareholders’ rights, before the management will hold the board meeting to determine agendas at the shareholders’ meeting the following year, the management can notify shareholders in advance via SETLink, so as to include shareholders in proposing the agenda and nominating the board members to the management to consider.

- The listed company may notify shareholders via SETLink that they have disseminated the invitation letter along with the annex on the company’s website, so as to provide the shareholders sufficient time to consider the agenda and related documents.

Rights to attend the shareholders’ meeting determined by the record date

Rights to attend the shareholders’ meeting determined by the book closing date

* In case there is an important agenda such as connected transactions, acquisition or disposition of assets, voluntary delisting, issuing securities to the directors or employees, etc.

* In case there is an important agenda such as connected transactions, acquisition or disposition of assets, voluntary delisting, issuing securities to the directors or employees, etc.

Related Regulations

|

The listed company must publicize the shareholders’ meeting via newspaper advertisement not less than three days before the meeting. Concerning overseas newspaper, it will be per the company’s Articles of Association (Public Limited Companies Act, Section 101)

- Provide additional explanation in the meeting invitation letter regarding the power of attorney, the rights of agent, and what to consider in granting authorization to act on one’s behalf. The shareholders will therefore be able to consider the benefits or effects from granting power of attorney.

- The listed company may nominate at least one independent director as authorized agent, so as to provide an alternative to shareholders.

- Specify clearly in the shareholders’ meeting rule that the agent be required to disclose all details in written form. The information should include profile brief, number of shares authorized, and the reasons why agent is invited, the voting of each agenda. These could be useful information for eligible persons. The views of inviting shareholders over each agenda are also useful material to be sent to the shareholders prior to the meeting.

The board must hold an ordinary shareholders’ meeting when asked by the shareholders whose collective holding is over 10 percent of issued shares. They have to clearly specify in the letter about the outlining matter and reasons why they call for a meeting. Then the board has to hold the shareholders’ meeting within 45 days from the date they receive a letter from shareholders. (Public Limited Companies Act, Section 100)

There must be at least 25 attendees, both eligible and authourized shareholders; or no less than half of total shareholders holding no less than one third of the issued shares. (Public Limited Companies Act, Section 103)

The meeting organizer must announce that there needs to be another meeeting, which is not necessarily in full quorum. If the meeeting has actually held by shareholders’ request, it could just be cancelled. (Public Limited Companies Act, Section 103)

There needs to be the majoirty vote, that means, more than half of the attending shareholders with the voting rights. (Public Limited Companies Act, Section 107)

For important agenda such as acquisition or disposal of business, merger, connected transactions, acquisition or disposal of assets, or an authorization to manage the business, the meeting organizer should notify shareholders about who at the meeting are the stakeholders of such cases, who would refrain from voting, and notify total number of shares muted. (Public Limited Companies Act, Section 107)

The meeting venue must be in the head office area or nearby provinces, with sufficient space to accommodate all attendees fairly. The shareholders should be facilitated if the venue is far from the main transportation route. Moreover, the company can hold the shareholders’ meeting through electronic means (e-Meeting), where the company’s article of associations does not specifically restrict.

The meeting organizer must review documents presented by the registrees before they enter the meeting room e.g checking personal ID card by themselves, checking the power of attorney form against the personal ID of the agent, or checking the passport of shareholders coming from overseas.

The registration should start two hours ahead of meeting.

For an agenda that needs voting, normally or secretly, the listed company must clearly specify the voting process, as well as keeping the shareholders aware of the case where their vote can become invalid.

To facilitate the meeting with transparency, the meeting organizer should annouce the voting scores counted immediately at that session.

* Immediately: information to be disclosed by 9 a.m. on the next working day or on the event date (The date of the board of directors or shareholders meeting's have resolution) 3 working days: Information to be disclosed within 3 working days after the event date