Definition

Definition

Derivative Warrants (DW) refers to:- An instrument in which the issuer gives the holders the right to buy (Call Warrant) the underlying asset at the predetermined time or period of time, under the conditions provided therein

- An instrument in which the issuer gives the holders the right to sell (Put Warrant) the underlying asset at the predetermined time or period of time, under the conditions provided therein

- An instrument in which the issuer gives the holder of the call option (Call Warrant) the right to receive payment at the predetermined time or period of time, in the amount calculated on the difference between the price or the value of the underlying asset and the price or the value of the underlying asset specified therein, when the price or the value of underlying asset is higher than the price or the value of underlying asset specified in such instrument, under the conditions provided in such instrument; or

- An instrument in which the issuer gives the holder of the put option (Put Warrant) the right to receive payment at the predetermined time or period of time, in the amount calculated on the difference between the price or the value of the underlying asset and the price or the value of the underlying asset specified therein, when the price or the value of underlying asset is lower than the price or the value of underlying asset specified in such instrument, under the conditions provided in such instrument

Applicant’s qualifications

Applicant’s qualifications

The company submitting an application to the SET for the listing of DW must hold the required qualifications set forth by the SEC. Qualifications of DW

Qualifications of DW

- Gaining approval from the SEC to offer the securities to the public in line with SEC rules

- Holding the bearer’s name

- Having no restriction on DW transfer

- Having any of the following underlying assets :

- common shares or group of common shares or group of common shares which are listed securities

- foreign index

- investment units of ETF

- other assets as prescribed by SET

- Common shares or group of common shares or group of common shares which are listed securities, not being issued by the company whose shares are during temporary trading suspension because it has grounds for possible of delisting, or undergoing the rehabilitation as per the Bankruptcy Law, or other reasons that may severely affect the shareholders’ benefits.;

DW which requires partial or no collateral must have additional qualifications:

- As of the application date, DW has the following assets as underlying securities:

- a) Common shares which are constituents of SET50 Index or SET100 Index

- Common shares among 51st-100th constituents of SET100 Index must be qualified in terms of market capitalization, in line with SEC rules, and are in the SET’s DW underlying securities list

- b) SET Index, SET50 Index, SET100 Index, SET High Dividend 30 Index, or the Industry Group Index and Sector Index.

- c) Foreign index with following qualifications:

- possess all the qualifications stipulated by the SEC notifications;

- possess all the elements of foreign index which are ordinary shares traded on a foreign stock exchange of a CLMV countries or traded on foreign stock exchange approved by the SEC, or traded on foreign stock exchange with the market capitalization ranked within top 30 as stipulated by SET;

- there is source of information for the foreign index that investor may access and follow up on during the day on a regular basis; and

- there is list of foreign index as announced by SET

- d) ETF investment units qualified as per SEC rules

- Terms of DW must not be less than 2 months and must not exceed 2 years from the date of issue.

- Be the DW as per the 3rd or 4th definition, which the exercise date has been specified European-style.

- Having total value of no less than 20 million Baht in each batch, and DW’s issue price must not be lower than one Baht on the application date.

- The numbers of DW which have already been issued or which are being applied for by all applicants at a certain time must use those underlying shares not more than 50 percent of shares sold. In case the underlying assets of DW are foreign shares, the underlying shares must not be more than 15 percent of the number of underlying shares listed on the foreign exchange.

- The applicant must distribute DW holding by no less than 20 million Baht or no less than 50 percent of DW under filing, excluding DW held by the applicant and market maker within three months or throughout the period of DW starting from the date DW is listed, whichever is earlier.

- Having the market maker with the qualifications and duties under the regulations of SET and always active through the period when DW is listed.

Filing the Application for the listing of DW

Filing the Application for the listing of DW

- The applicant must receive confirmation from SET about the allocation of common shares used as underlying assets (in case underlying assets are common shares or foreign ).

- The applicant files for the listing of all DWs approved by SEC.

- DW offering must start within a period specified by SET

- Must engage a financial advisor stipulated by the SEC notifications unless the applicant is a financial advisor.

- Designate the SET, or third party approved by the SET, to be registrar.

In applying for the listing of additional DW, the applicant must distribute the holding of DW in accordance with the stipulated conditions i.e. the distribution must not less than 20 million Baht or 50% of the DW applied for.

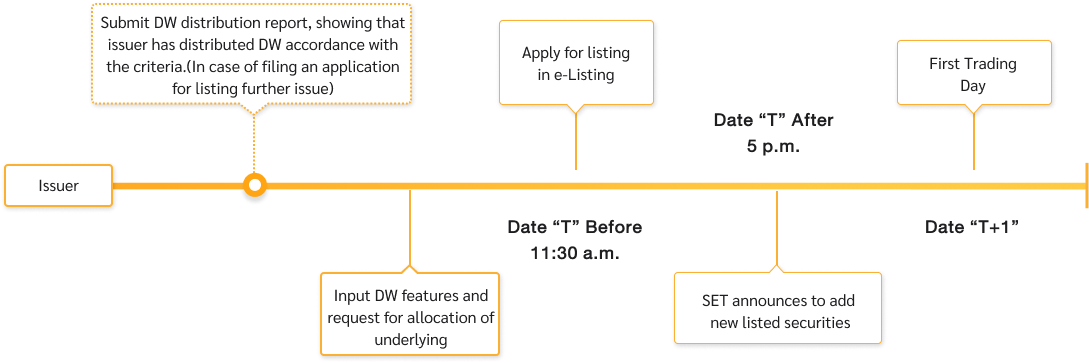

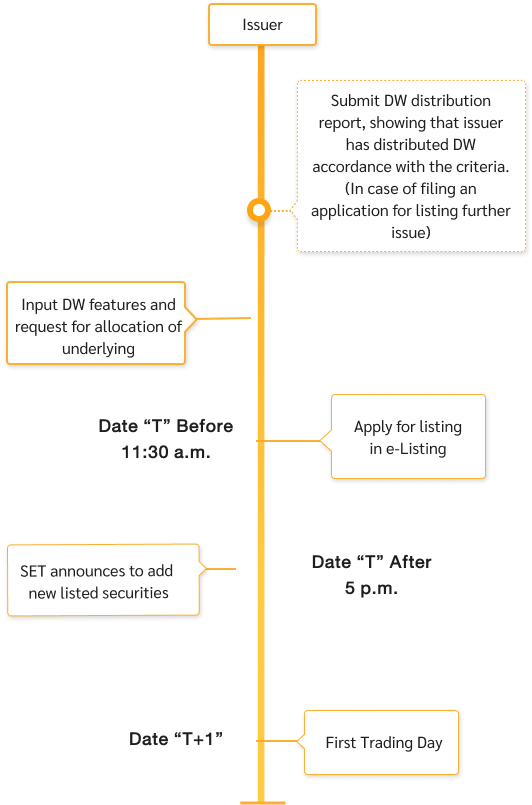

SET has developed DW One-Stop Service system to facilitate issuer in submitting the application, more detail at www.set.or.th > Products/Services > DW

SET has developed DW One-Stop Service system to facilitate issuer in submitting the application, more detail at www.set.or.th > Products/Services > DW

DW listing fee

DW listing fee

- 68,000 baht per DW

Process of DW listing application (New Issue)

Related Regulations

|

|

Q&A

The applicant must reserve the underlying shares via The applicant must reserve underlying shares via “DW One-Stop Service” system only.

The applicant can file listing for incremental DW only when the distribution of issued DW is complete.