A holding company is a company whose primary source of income is the ownership of shares in other companies, with no significant business of its own. A holding company invests in local or foreign subsidiaries that operate a core business in the country and/or other countries, and must not have the characteristics of an investment management company (Investment Company).

A holding company is a company whose primary source of income is the ownership of shares in other companies, with no significant business of its own. A holding company invests in local or foreign subsidiaries that operate a core business in the country and/or other countries, and must not have the characteristics of an investment management company (Investment Company).

Why structured as a holding company ?

The Company can grow by increasing its investments in both related and unrelated business lines, both domestically and/or internationally. |

Having different structured companies within the group may cause difficulties in selecting a specific company to be listed on the SET. |

Merging companies with different business lines may be subject to operational, tax, or legal constraints. |

Qualifications for Listing of a Holding Company

Why is it structured as a holding company?

The Company can grow by increasing its investments in both related and unrelated business lines, both domestically and/or internationally. |

Having different structured companies within the group may cause difficulties in selecting a specific company to be listed on the SET. |

A merger of companies with different business lines may be subject to operational, tax, or legal constraints. |

Qualifications for Listing of a Holding Company

A holding company’s operation shall not be in a manner of investment management |

The primary goal of a holding company's operations must be to make investments that allow it to participate in the management of the companies in which it has invested |

A holding company must choose a company operating core business (Core Company) over which it has management control in proportion to its shareholding |

A core company must be a subsidiary company of the holding company |

If a core company is subject to limitations prescribed under other laws or conditions set in the joint investment with the public sector, its holding company must hold not less than 40% of the total number of shares in such company and can prove that it is involved in the management of such company at least in accordance with the proportion of its shareholding in such company |

A holding company must be a company with operational performance that meets the criteria for securities listing and must maintain its shareholding in the core company throughout the listing period. It can replace the core company upon the lapse of 3 years from the commencement date of trading on the Exchange |

Table comparing the listing of a Holding Company and an Operating Company

| Holding Company | Operating Company | |

| Business nature | It has no significant business of its own and invests primarily by holding shares in other companies | Own a primary business such as manufacturing, distribution, and sales of products and services |

| Revenues | Dividends | Revenues from sales of products and services |

| Market | SET / mai | SET / mai |

| Listing Criteria | Profit Test Market Cap. Test (SET only) | Profit Test Market Cap. Test (SET only) |

| Applicant | Holding Company | Operating Company |

| Qualifications (quantity and quality) | Holding Company and subsidiary company operating core business (Core Company) | Operating Company |

| Qualifications of a core company investing in infrastructure projects (Infrastructure Project) will be subjected to other relevant criteria. | ||

| Management | Holding Company | Operating Company |

| A Holding Company must have management control over the core company in proportion to its shareholding | ||

| Silent period | Normal criteria | Normal criteria

|

| A company whose primary business is to invest in infrastructure projects (Infrastructure Project) will be subjected to additional relevant criteria. | ||

| Listing status | Normal criteria | Normal criteria such as maintaining the shareholding of minority shareholders (Free float) |

Holding Company

| ||

A core company must have the following qualifications:

|

- A company tends to establish its new subsidiaries in order to expand the business both domestically or overseas, which can be related or unrelated to its current business.

- Many companies acquire subsidiaries with various firm structures while some of their subsidiaries also expect to list on the Exchange.

- For the conglomerates, listing as a holding company allows them to avoid difficulty in terms of selecting the best representative to submit for listing.

The company being categorized as a company operating main business

- The said company must be a subsidiary of Holding Company.

- If a subsidiary operating main business is subject to government-joint investment or other laws, the holding company must hold ≥ 40% of the subsidiary operating main business shares and be able to show management control proportionally to its shareholding.

The holding company has to meet the qualification of operating result as listing regulation and maintain its shareholding in the subsidiary operating main business through the listing period. The subsidiary operating main business can be changed after three years from listing date. Holding company which has not reached 3 years of holding its core company has to be complied with specified period.

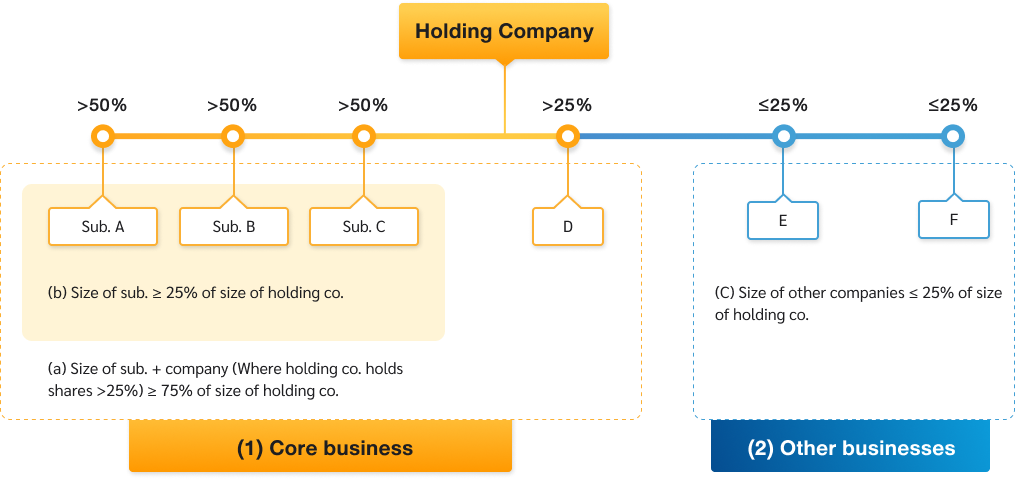

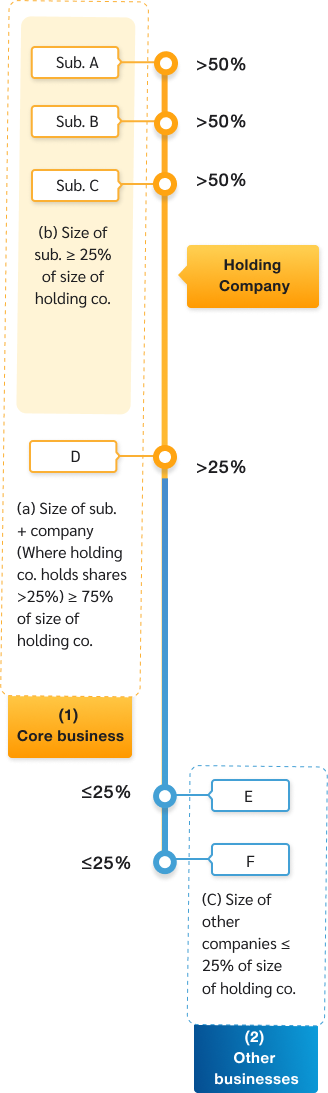

The holding company’s proportion of investment in the group of companies that engage in core business comparing to the total assets of the holding company is as follows.

- Total size of all investment in subsidiaries and associates being held > 25% operating the core business, not less than 75% of the holding company’s total assets.

- The size of its core-business subsidiaries not less than 25% of the holding company’s total assets.

| Listing Rules and Regulation in the Stock Exchange of Thailand (SET) and Market for Alternative Investment (mai) |

- having a par value not less than Baht 0.5 per share and being fully paid-up

- bearing holders’ names

- having no restrictions on transfer of ordinary shares, unless the restrictions are in accordance with laws and are included in the articles of association of the company

| Subject | The Stock Exchange of Thailand (SET) | Market for Alternative investment (mai) |

| Status | Must be a public limited company or corporation established under special law. | |

| Paid-up Capital (After IPO) | ≥ THB 300 million | ≥ THB 50 million |

| Financial condition and liquidity |

|

|

| Track record | Profit Approach (Profit Test) Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities

| Profit Approach (Profit Test) Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities

|

| Market Capitalization Approach/1 The specification shall be in accordance with the Market Cap Test criteria. | ||

| Distribution of minority shareholders or free float /2 (After IPO) |

|

|

| Public Offering Approval |

| |

|

| |

| Directors and executives | Having the directors and management who are responsible for the management of subsidiary operating main business ≥ 1 years prior to listing application and continuously until the date of approval for being listed securities, except for the following events: (a) the Applicant is a financial institution of which the regulatory agency has otherwise prescribed rules in relation to directors and management; or (b) the Operating Core Business Company has an investment in a project which is a Basic Public Utilities that is beneficial to Thailand; | |

| Nature of Business Operation |

| |

| Management and control personnel |

| |

| Corporate governance and internal control |

| |

| Conflicts of interest | Must have no existing or potential conflicts of interest as defined by The Capital Market Supervisory Board/3. | |

| Financial statements and auditors |

| |

| Provident fund | By the date the listing application is filed, the applicant has established a provident fund. | |

| Registrar | Appoint TSD or an approved registrar by SET | |

| Silent Period | Net Profit Approach The silent period extends for one year after listing. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. They are permitted to sell 25% of the locked-up shares after 6 months. Infrastructure Business Approach The silent period extends for three years after the trading date. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. Upon completion of 1 year period, they are permitted to sell 20% of the lock-up shares. Then, after every six months they are permitted to sell 20% of the locked-up shares. | |

| Market Capitalization Approach/1 The specification shall be in accordance with the Market Cap Test criteria. | ||

| The arranging of a meeting to present and clarify any information regarding business and operating results | Net Profit Approach The company must organize a meeting to present and clarify the information about business and performance to shareholders, investors and related persons at least 1 time within the first year after having been listed in order to allow them access to relevant information and opportunity of raising queries to the management of the listed company. Market Capitalization Approach/1 The specification shall be in accordance with the Market Cap Test criteria. | |

Remark:

/1 The Additional regulations of listing ordinary shares in the Stock Exchange of Thailand (SET) by Market Capitalization Test - please visit Common Shares Listing Admission - General Listing for Common Shares

- Market Capitalization Calculation

- IPO price: the candidate applies for listing within a year from the last date of its IPO.

- Fair price determined by financial advisor: the candidate applies for listing after a year from the last date of its IPO.

- Board of director, management, and related person

- Shareholders held > 5% of paid-up capital and related persons.

- Persons who has controlling power

/3 Notification of the Capital Market Supervisory Board No. Tor Jor. 39/2559 Applications for Approval and Granting of Approval for Offering of Newly Issued Shares (Codified).

/4 The definition of an Investment Company in accordance with the Notification of the Capital Market Supervisory Board, means investments in securities, derivatives or digital assets in one or more of the following manners at a collective total exceeding 40 percent of the total assets as per the most recent financial statements or the consolidated financial statements.

- (1) Investments in shares in another company which is not, or will not become, a subsidiary or an associate, except for the investment in companies that cooperate or support businesses, or an affiliated company under the same parent company, or a network company that can demonstrate a policy or direction of cooperation or support for mutual operations.

- (2) Investments with the objective of generating returns from increases in capital gain or other returns exempted investment in government bonds, debt instruments issued by the Ministry of Finance with an unconditional, full guarantee of principal and interest and units in money market funds or units in general fixed income funds.

- The calculation of the proportion of such investments includes the investments in securities, derivatives or digital assets of subsidiary which is a non-financial institution and the investments in shares which are issued by an associate and engaged a non-financial institution.

| Subject | The Stock Exchange of Thailand (SET) | Market for Alternative investment (mai) |

| Status | Must be a public limited company or corporation established under special law. | |

| Paid-up Capital (After IPO) | ≥ THB 100 million | ≥ THB 50 million |

| Financial condition and liquidity |

|

|

| Track record | Profit Approach (Profit Test) Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities

| Profit Approach (Profit Test) Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities

|

| Market Capitalization Approach/1 | ||

| Distribution of minority shareholders or free float /2 (After IPO) |

|

|

| ||

| Public Offering Approval |

| |

| Directors and executives | Having the directors and management who are responsible for the management of subsidiary operating main business ≥ 1 years prior to listing application and continuously until the date of approval for being listed securities, except for the following events: (a) the Applicant is a financial institution of which the regulatory agency has otherwise prescribed rules in relation to directors and management; or (b) the Operating Core Business Company has an investment in a project which is a Basic Public Utilities that is beneficial to Thailand; | |

| Nature of Business Operation |

| |

| Management and control personnel |

| |

| Corporate governance and internal control |

| |

| Conflicts of interest | Must have no existing or potential conflicts of interest as defined by The Capital Market Supervisory Board/3. | |

| Financial statements and auditors |

| |

| Provident fund | By the date the listing application is filed, the applicant has established a provident fund. | |

| Registrar | Appoint TSD or an approved registrar by SET | |

| Silent Period | Net Profit Approach The silent period extends for one year after listing. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. They are permitted to sell 25% of the locked-up shares after 6 months. Infrastructure Business Approach The silent period extends for three years after the trading date. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. Upon completion of 1 year period, they are permitted to sell 20% of the lock-up shares. Then, after every six months they are permitted to sell 20% of the locked-up shares. | |

| Market Capitalization Approach/1 The specification shall be in accordance with the Market Cap Test criteria. | ||

| The arranging of a meeting to present and clarify any information regarding business and operating results | Net Profit Approach The company must organize a meeting to present and clarify the information about business and performance to shareholders, investors and related persons at least 1 time within the first year after having been listed in order to allow them access to relevant information and opportunity of raising queries to the management of the listed company. Market Capitalization Approach/1 The specification shall be in accordance with the Market Cap Test criteria. | |

Remark:

/1 The Additional regulations of listing ordinary shares in the Stock Exchange of Thailand (SET) by Market Capitalization Test - please visit Common Shares Listing Admission - General Listing for Common Shares

- Market Capitalization Calculation

- IPO price: the candidate applies for listing within a year from the last date of its IPO.

- Fair price determined by financial advisor: the candidate applies for listing after a year from the last date of its IPO.

- Board of director, management, and related person

- Shareholders held > 5% of paid-up capital and related persons.

- Persons who has controlling power

/3 Notification of the Capital Market Supervisory Board No. Tor Jor. 39/2559 : Applications for Approval and Granting of Approval for Offering of Newly Issued Shares (Codified).

/4 The definition of an Investment Company in accordance with the Notification of the Capital Market Supervisory Board, means investments in securities, derivatives or digital assets in one or more of the following manners at a collective total exceeding 40 percent of the total assets as per the most recent financial statements or the consolidated financial statements.

- (1) Investments in shares in another company which is not, or will not become, a subsidiary or an associate, except for the investment in companies that cooperate or support businesses, or an affiliated company under the same parent company, or a network company that can demonstrate a policy or direction of cooperation or support for mutual operations.

- (2) Investments with the objective of generating returns from increases in capital gain or other returns exempted investment in government bonds, debt instruments issued by the Ministry of Finance with an unconditional, full guarantee of principal and interest and units in money market funds or units in general fixed income funds.

- The calculation of the proportion of such investments includes the investments in securities, derivatives or digital assets of subsidiary which is a non-financial institution and the investments in shares which are issued by an associate and engaged a non-financial institution.

|

|

|

|

|

|

|

|

|

Related Information