DW

Disclosure rules

Derivative Warrant (DW) is a financial instrument that requires a small initial investment but yields high returns. Profits can be made during both market ups and downs.

Derivative Warrant (DW) is a financial instrument that requires a small initial investment but yields high returns. Profits can be made during both market ups and downs.

Rule summary

| Required disclosure | Submission deadline |

|---|---|

| Annual financial statements (audited) | Within the same time frame of submission to regulators directly supervising the business operations or, or to the Ministry of Commerce, whichever is earlier. |

| Semi-annual financial statements (audited) | |

| Quarterly financial statements (reviewed) | |

| 56-DW | Concurrent with the submission of the annual financial statements |

| Required disclosure/submission | Disclosure/submission deadline |

|---|---|

| Outstanding DW units (Weekly) | Every week |

| DW holding distribution reports | Within 3 months from the first trading day |

| Monthly performance reports of market makers | Within 3 business days from the end of each month |

| Required disclosure | Disclosure time frame |

|---|---|

| Immediately |

| Settlement prices and net cash settlements | No later than the next business day after the information becomes available |

| Result of DW exercise | Next business day following the exercise date |

| Disclosure of book closing dates (BC) or record dates (RD) | ≥ 5 business days prior to BC or RD |

| Changes to BC or RD | ≥ 5 business days prior to BC or RD previously disclosed |

| Minutes of DW holder meetings | Within 14 days from the date of each meeting |

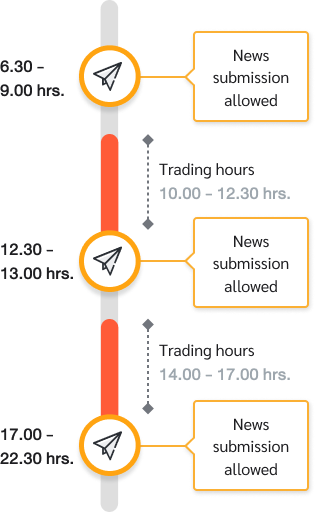

Time interval for information disclosure via SETPortal

| please contact the Equity Product Development Department, The Stock Exchange of Thailand | |

| please contact the Equity Product Development Department, The Stock Exchange of Thailand | |