Warrant (RO / PPO / PP / PO)

Warrant (RO / PPO / PP / PO)

An instrument that grants the holder the right to purchase securities (underlying assets) at the exercise price and amount (exercise ratio) specified during a pre-defined exercise period.

Benefits of warrants

| Company | ||

| The company can set the warrant's terms and exercise period based on when it needs the capital. This will allow the company to better utilize its capital, slow the dilution effect, and reduce the debt-to-equity ratio to an appropriate level | ||

| Increase the opportunity to broaden the investor base because warrant investors may be different from ordinary share investors, and popular warrants are likely to make the company's ordinary shares more appealing | ||

| When warrant holders exercise their rights, the number of ordinary shares increases, increasing share liquidity | ||

| Issuing warrants concurrently with other financial instruments will generate more interest and lower funding costs for the offered financial instruments | ||

| Shareholders | ||

| If the exercise price is lower than the market price in the future, shareholders will be able to exercise their rights to purchase the company's shares at a lower price (Warrant in-the-market) | ||

| The right offering warrant reduces the dilution effect because warrant holders can choose to exercise their rights or sell the warrants on the market if they are listed on the SET | ||

| Have more investment options because investors who want to invest in company shares can instead do so through warrants, which are typically priced lower and fluctuate proportionally higher than or in line with the company's share price | ||

| Warrants increase trading liquidity, allowing shareholders to profit indirectly from trading their shares | ||

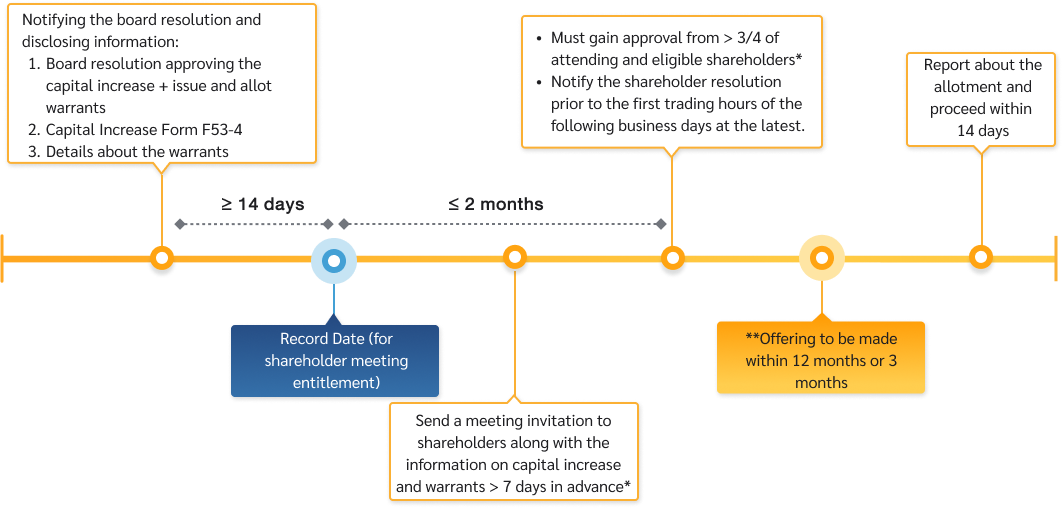

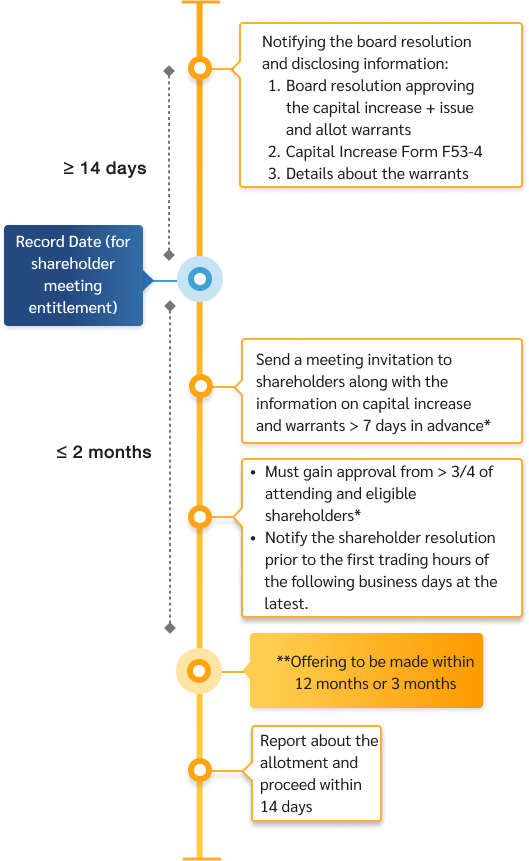

When a listed company would like to issue and allocate its warrants, the company has to disclose relevant information and performing relevant actions such as disclosing the board’s resolution, seeking approval from shareholders, allocating the warrants and reporting results, reporting about the conversion of warrants to common shares, and registering these additional common shares.

If the listed company wish to get their warrants traded on SET to enhance liquidity to unitholders, it needs to follow the listing process and notify shareholders about their conversion rights.

| Warrant Issuance and Allotment |

- The company has to notify, via SETLink, about the board resolutions on warrant issuance and allotment immediately, that is within the day the board has reached the resolution prior to the first trading hours of the following business day at the latest.

- Information to be disclosed when the warrants are issued and allocated:

- Persons receiving an allotment

- Right Offerings (Warrant RO)

- Right Offerings except offering to persons who would cause the company to have duty under foreign law (Warrant PPO)

- Public Offerings (Warrant PO)

- Private Placement* (Warrant PP)

*Private Placement is an allocation to no more than 50 persons, or the allotment value not exceeding 20 million baht within 12 months (including the selling and exercise prices), or to institutional investors.

- Preliminary details about warrant issuance and allotment

- Warrant title, warrant quantity, No. of shares reserved for an exercise of warrants, terms, offering price, exercise price and ratio, exercise period including the first and last exercise dates, ex-warrants date, subscription and payment dates, exercise method, secondary market, conditions for the rights adjustment, and dilution effect.

- Persons receiving an allotment

- Capital increase upon exercise of warrants (Follow the process of capital increase)

- Hosting the shareholders’ meeting (Follow the process of shareholders’ meeting)

Deliver an invitation letter to shareholders along with related documents 7 days prior to the meeting date. However, for warrant PP case, the company needs to deliver the invitation 14 days in advance, plus additional following information:

Details required in the invitation letter to the shareholder meeting

- Details about an offer, for example:

- No. of warrants for buying the newly issued shares

- No. of newly issued shares reserved for the above mentioned warrants

- No. of PP shares issued along with warrant PP offer (if any)

- Type of investors receiving an offer

- Calculation method for the offering price, conversion ratio, and market price

- Method of offering and allotment

- Exercise period

- Expiry date for warrant conversion

- Rationale for new shares issuance upon the rights adjustment

- Others (if any)

- Requirement for the conversion to be completed within warrant term

- Objectives of warrant PP offering

- Clear objectives about warrant PP issuance

- Plan on the use of fund raised through warrant PP

- Details about the project

- Effects on the shareholders upon warrant PP offering

- Earnings per share dilution or the control dilution

- Benefits to the shareholders compared to their profit or rights dilution

- The directors’ views

- Rationale and the necessity to increase capital

- Possibilities on the use of fund raised through the offering

- Rationality of capital increase, the use of fund, and planned project, adequacy of the fund raised through securities offering which has not covered overall budget required for the mentioned plan or project.

- Possible effects to the company’s business, including financial positions and operational performance after the capital increase and using the proceeds as planned.

- Suitability and rationality of designated market price and offering price.

- Other information (if any), please specify.

- A statement informing the shareholders of their rights to claim the losses in case the company’s director fails to comply with the fiduciary duty.

- In the event that the shareholders are to reach for a solution on the selling prices, for both warrant PP and post-offering proportional allotment to shareholderst he company shall provide information additional to 1 – 5 items as follows:

6.1 List of investors to receiving the offering

6.2 Opinion of the Board of Directors on one of these issues:

A) Rationale of the warrant PP price to be offered to investors in 6.1

B) Determination of the selling price

C) Rationale and the need in offering the warrants to investors in 6.1

6.3 Certified statement by the directors showing that they have carefully considered and examined PP investor information in 6.1 that the investors have potentials to invest, or have managed to ensure that they can make the investment happen. - When the shareholders shall reach a resolution about the offering price of shares reserved for warrants and such price is below the market price, or when the warrants after rights offering shall be sold below the fully diluted price, the company has to take these steps in addition to the above 1. – 6.:

- Rights of the shareholders to oppose the offering at a low price. Veto shall not ≥10% of total votes from participating shareholders.

- The Board of Directors’ opinion on:

A) PP Investors: Considering whether the investors have any business which could be supporting the listed company in terms of expertise or experience, which could be beneficial to the company.

B) Worthiness: The value of benefits from investors compared to new shares being offered at a low price to them, which affect the company’s expense and financial positions according to the share-based payments

- Letter of Proxy: At least one person who receive authority shall be an independent director. Also, if that independent director has involved in the transaction, it must be clearly stated.

- The offering must be approved at the shareholder meeting with no less than 3/4 of votes from shareholders who were present and eligible to vote. For the case of discounted offering price, there must be no more than 10% veto from shareholders who were present and eligible to vote.

Remark

*1 For multi-purpose use of funds, details, budget, and the funding planned for each purpose must be separately and clearly identified.

*2 In case of connected transactions or being subject to the acquisition or disposal of assets, the shareholders’ approval as per related announcements is required and must be stated in the agenda, so that the transaction can be done upon approval.

*6 The warrant offering price is based on offering and exercise price of Warrant PP.

*7 The shareholders should be informed that the figures are only estimates for their primary consideration. The exact number will be based on the share prices on the SET on the date they have become entitled.

*1 For multi-purpose use of funds, details, budget, and the funding planned for each purpose must be separately and clearly identified.

*2 In case of connected transactions or being subject to the acquisition or disposal of assets, the shareholders’ approval as per related announcements is required and must be stated in the agenda, so that the transaction can be done upon approval.

| *3 Price Dilution = | Pre-offering market price – Post-offering market price |

| Pre-offering market price |

| Post-offering market price = | (Mkt price x Paid-up shares) + (Offering price of shares reserved for warrants x No. of warrants allocated) + (Exercise price x No. of shares received after conversion) |

| Paid-up shares + Total shares offered |

| *4 Earnings Per Share Dilution = | Pre-offering earnings per share – Post-offering earnings per share |

| Pre-offering earnings per share | |

| Pre-offering earning per share = Net profits / Paid-up shares Post-offering earnings per share = Net profits / (Paid-up shares + Total shares offered) |

| *5 Control Dilution = | Total shares offered |

| Paid-up shares + Total shares offered |

*7 The shareholders should be informed that the figures are only estimates for their primary consideration. The exact number will be based on the share prices on the SET on the date they have become entitled.

Within the shareholder meeting date, or prior to the first trading hours of the following day at the latest via SETLink system.

Within 14 days from the closing and payment date (or the day warrants are issued as free warrants) via SETLink system using the Securities Offering Report Form (F 53-5)

Tips

The listed company must clearly notify about the conditions for rights adjustment in the shareholder meeting invitation, for example, when the company pay out dividend more than 75% of net profits after tax, during an accounting period when the warrants are still valid.

| Comparison of SEC Rules by Type of Warrant Issuance and Allotment |

| Features | Type of Allotment | ||

| Existing shareholders/PP0 | General public | Private placement | |

| Feature of Warrants | |||

|  |  |  |

|  |  |  |

|  |  |  |

|  |  | |

|  |  | With transferring limitation |

| Requirements for the listed company | |||

|  | ||

|  | * | |

|  |  |  |

|  |  |  |

|  |  |  |

|  |  |  |

|  | ||

|  |  |  |

|  |  | * |

| RO 1 year PPO 6 months |  | * |

|  |  | |

|  |  |  |

Remark

*Depending on how the offering price is determined as per the rules on PP warrants issuance and offering.

**The company must specify the case and conditions about the rights adjustments that “The listed company will notify about warrant ratio and price before the previous ratio or conversion will take effect.”

*Depending on how the offering price is determined as per the rules on PP warrants issuance and offering.

**The company must specify the case and conditions about the rights adjustments that “The listed company will notify about warrant ratio and price before the previous ratio or conversion will take effect.”

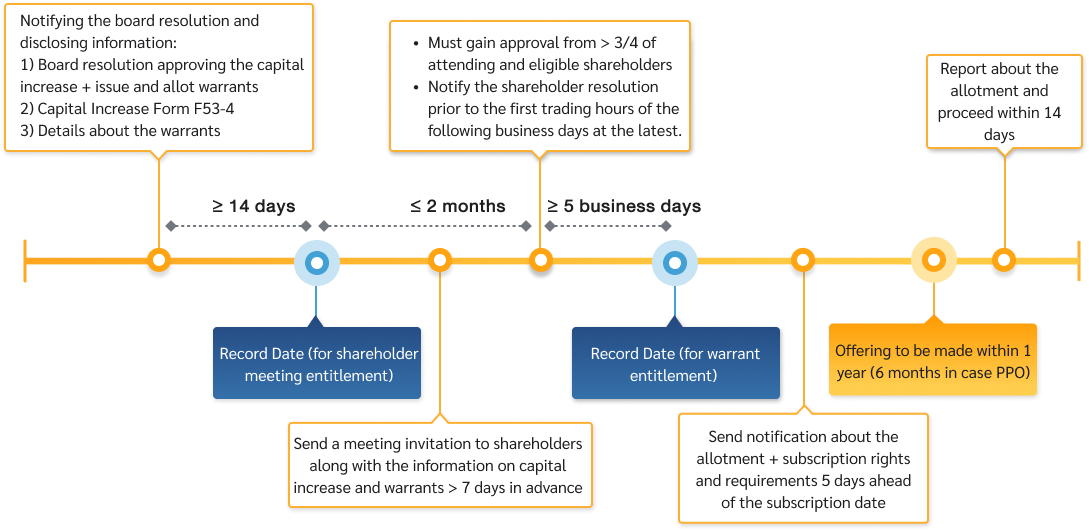

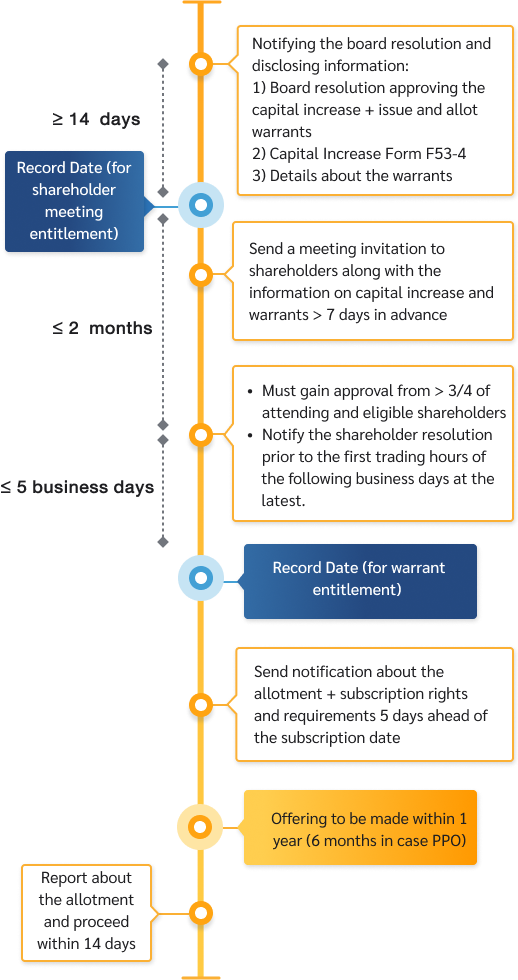

Warrant allotment to existing shareholders/ PPO

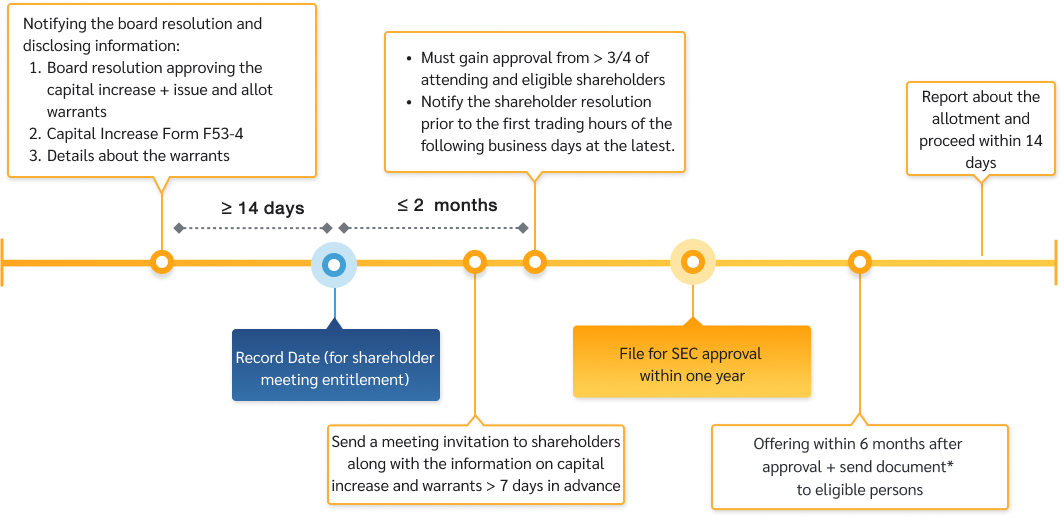

Warrant allotment to via public offering

*Send notification about the allotment, subscription rights and requirements to eligble persons

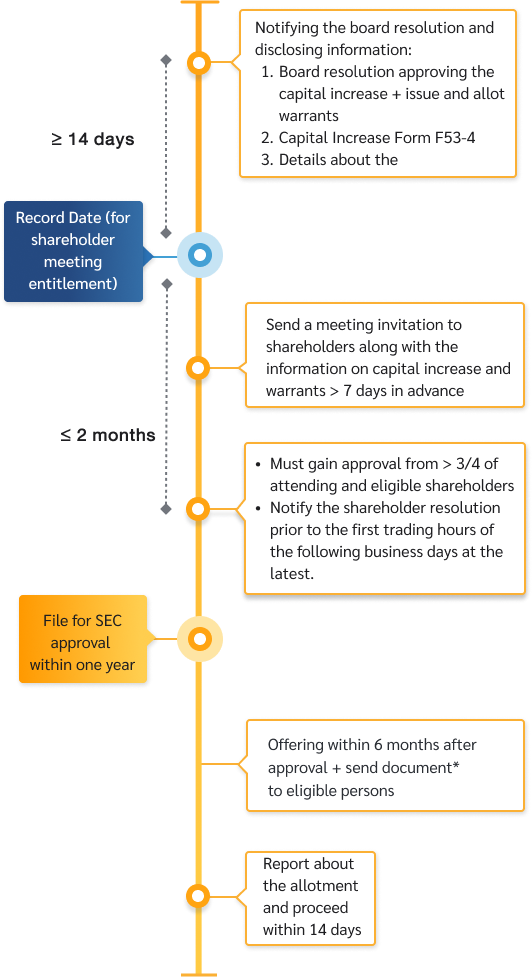

Warrant allotment to via private placement

* In case of PP offering at a low price as per SEC rules

- Meeting invitation letter and information about the capital increase shall be sent to shareholders > 14 days in advance

- Must gain approval from > 3/4 of attending and eligible shareholders, with objections not >10% attending and eligible shareholders

**12 months in case offering at market price or 3 months in case offering at fixed price, according to SEC’s rules on PP warrant issuance and offering

- Meeting invitation letter and information about the capital increase shall be sent to shareholders > 14 days in advance

- Must gain approval from > 3/4 of attending and eligible shareholders, with objections not >10% attending and eligible shareholders

**12 months in case offering at market price or 3 months in case offering at fixed price, according to SEC’s rules on PP warrant issuance and offering

Related Regulations

|

|

|

|

|

Forms

|

|

Issues for consideration

|

|

|

|

|

|

|

|

Q&A

- In case of Warrant PO, the company shall make the offering within 6 months after the SEC has notified about the approval, or within the period relaxed by the SEC, but no later than 12 months

- In case of Warrant RO, the offering must be made within one year after gaining approval from shareholders

- In case of Warrant PPO, the offering must be made within 6 months after gaining approval from shareholders

- In case of Warrant PP, the offering must be made within 12 months for offering at market price or within 3 months for offering at fixed price

When the company allocate warrants proportionately to the shareholding, the company has to send terms of rights and notification to allot warrants to all shareholders. If the allocation has a price, the notification must be sent before the warrant subscription and payment dates (The company may send the notification no less than 5 business days before the warrant subscription and payment dates, in line with an allocation of capital increase shares.)

The company may determine the subscription and payment dates no less than 5 business days before the warrant subscription and payment dates, in line with an allocation of capital increase shares.

((No. of shares reserved for warrants + No. of shares allocated for convertible debentures or other warrants excl. ESOP) / Total shares sold + No. of shares to be sold along with warrants) *100 Please note that the calculation should be made on the date the board reaches the resolution to issue warrants.

- Changes in the par value of company’s shares, as a result of the share merge or split

- Offering newly issued shares at a low price

- Offering the convertible debentures or warrants at a low price

- Paying out all dividend, or paying partial dividend with newly issued shares

- Paying the dividends in cash at a ratio higher than the rights specification

- Other cases similar to 1) to 5) which will yield inferior benefits in warrant conversion.

The company must clearly state the conditions to inform shareholders