General Mandate

An alternative approach to a capital increase where the shareholders approve the number of shares and types of allotment at a shareholders’ meeting in advance and authorize the company's board of directors to consider each issuance and allotment as appropriate. Full disclosure of the information is required each time the company's board of directors allots the newly issued shares.

Forms of Capital Increase

1. Capital increase with specific objectives

1. Capital increase with specific objectives

- The purpose of funds utilization, number of issued shares, and allotment are explicitly specified.

- Shareholders approve the capital increase knowing the scope of allocation but not the objectives or other details

- Shareholders authorize the board of directors to issue and allot newly issued shares where full disclosure of information is required upon each allotment

Benefits of General Mandate

Company

| Enhance the flexibility and speed in fundraising to cope with volatile market and other factors |

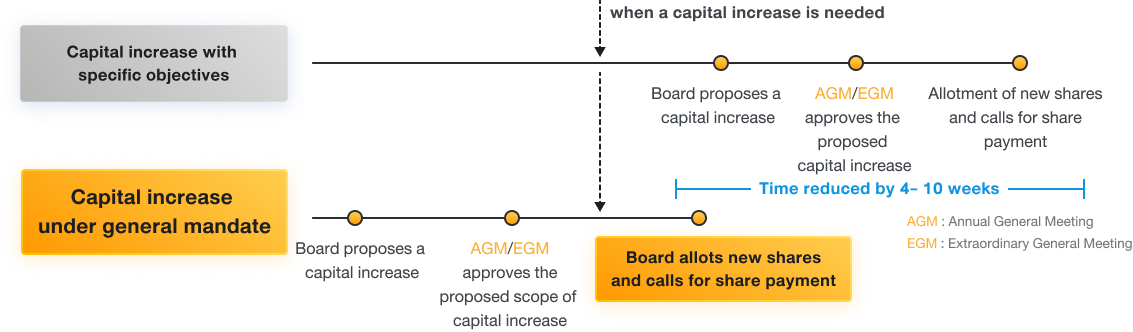

| Reduce procedures and time by 4-10 weeks because no shareholders’ meeting is required for each capital increase approval |

| Reduce expense of holding a shareholders’ meeting to approve a capital increase each time fundraising is required |

| Provide another fund-raising option |

Shareholders

| Provide sufficient working capital to meet the business needs and circumstances and thereby generating returns for shareholders. |

| Shareholders are sufficiently protected under the regulations for capital increase by general mandate |

| Able to estimate potential short-term dilution effects |

Conditions of Capital Increase under General Mandate

| RO | PPO | PO | PP | |

| The number of shares is calculated on the company's paid-up capital as of the date the board of directors resolves to increase capital under General Mandate | Not exceeding 30% | Not exceeding 20% | Not exceeding 10% | |

| The total paid-up capital of new shares shall not exceed 30% where the issuance via PP and PO shall not exceed 20% | ||||

| Offering price | Not specified | Not at a discount price | ||

| Issuance and Allotment period | Until the next AGM or the date the next AGM is required by law (whichever comes first) | |||

| Types of Securities | Ordinary shares, Preferred shares, TSR* | Ordinary shares, Preferred shares | ||

* TSR means Transferable Subscription Rights

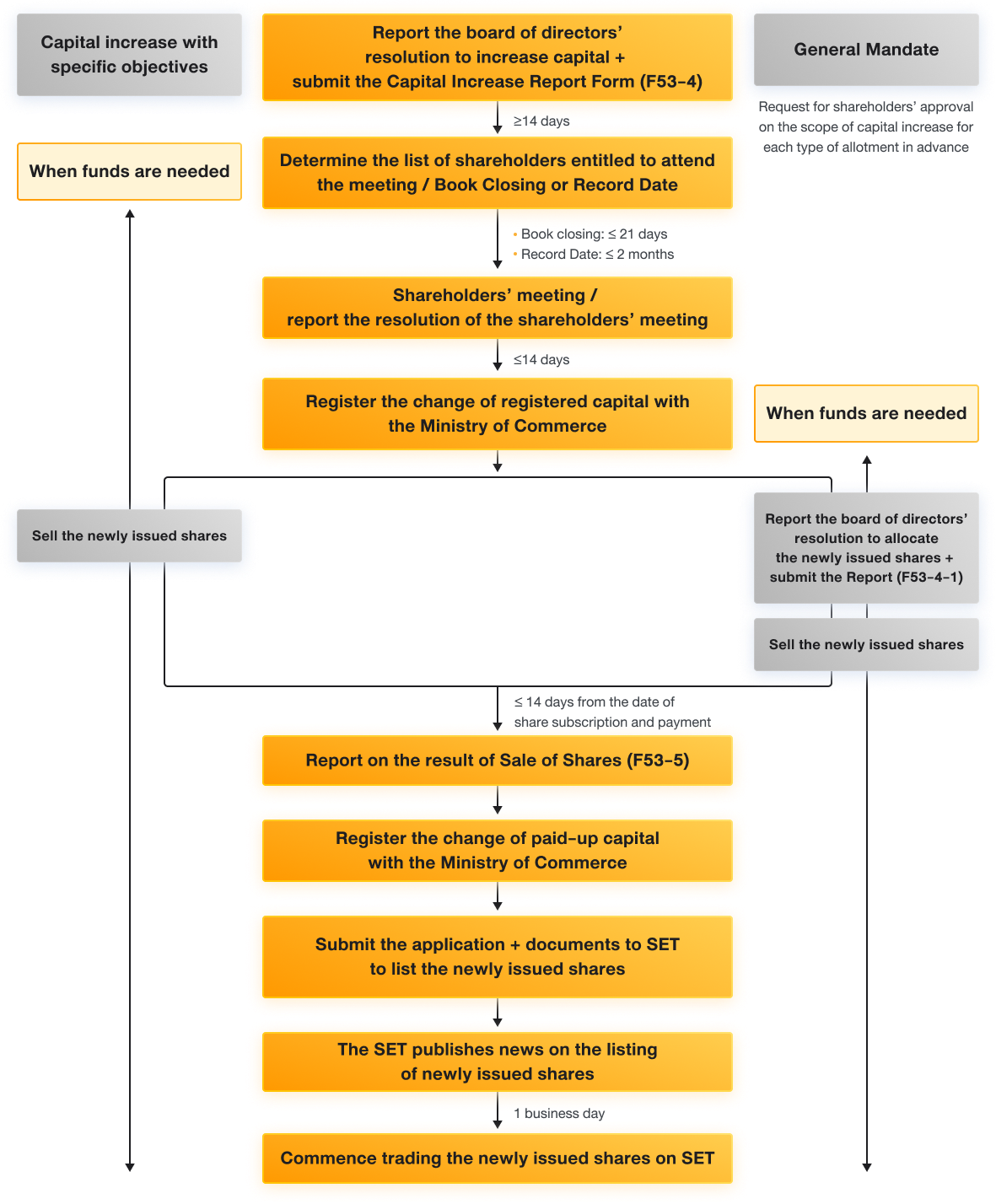

Key Procedures

The information to be disclosed in the Capital Increase Report Form

| Remark |

must disclose |

disclose (if any) |

disclosure not yet required |

- *PP at a discounted price means PP at a price below 90% of the market price (Weighted Average Costing (Average Trade Price) for the past 7-15 consecutive days before the first day the shares are offered to investors or the fair value assessed by FA (in case shares are not traded on SET/mai)

- In case of PP at a discounted price, such shares and converted securities will be prohibited from trading according to rules on Silent Period

Related Regulations

|

|

|

|

|

Points to be considered

Capital increase conditions

Since the board of directors is authorized by shareholders to issue and allot newly issued shares each time as appropriate, the board of directors must undertake its duty with honesty and sensibility for the maximum benefits without acting in conflict with the interest of the company and shareholders.

Since the board of directors is authorized by shareholders to issue and allot newly issued shares each time as appropriate, the board of directors must undertake its duty with honesty and sensibility for the maximum benefits without acting in conflict with the interest of the company and shareholders.

Seeking approval for capital increase

For clarity, the capital increase and allotment should be in separate agenda and should be discussed separately at the shareholders’ meeting because each agenda has a different voting requirement. A capital increase requires at least 3/4 of the total votes of shareholders attending the meeting and eligible to vote according to Section 136 of the Public Limited Companies Limited Act, B.E. 2535; whereas an allotment requires a majority vote under Section 137 of the Public Limited Companies Act.

For clarity, the capital increase and allotment should be in separate agenda and should be discussed separately at the shareholders’ meeting because each agenda has a different voting requirement. A capital increase requires at least 3/4 of the total votes of shareholders attending the meeting and eligible to vote according to Section 136 of the Public Limited Companies Limited Act, B.E. 2535; whereas an allotment requires a majority vote under Section 137 of the Public Limited Companies Act.

FAQ

The company may seek approval at either an AGM or an EGM, but it will be more convenient and cost-effective if the proposal is made at an AGM.

No, under Sections 136 and 137 of the Public Limited Companies Act, B.E. 2535 (1992), the resolution must clearly state the number of shares allotted through each fund-raising process (RO, PO, or PP) and specify the type of securities to be offered for sale (ordinary shares, preferred shares, and/or TSR).

This can be divided into 2 cases:

1. If the shares are not completely subscribed at the previous capital increase under general mandate, the company must first reduce the unsubscribed capital before seeking shareholders’ approval for the new capital increase under general mandate.

2. If the company fails to allot shares within the specified period, it may seek approval from the shareholders' meeting to extend the allotment period of the said General Mandate shares without having to first reduce the registered capital.

1. If the shares are not completely subscribed at the previous capital increase under general mandate, the company must first reduce the unsubscribed capital before seeking shareholders’ approval for the new capital increase under general mandate.

2. If the company fails to allot shares within the specified period, it may seek approval from the shareholders' meeting to extend the allotment period of the said General Mandate shares without having to first reduce the registered capital.

The company may proceed with the capital increase with specific objectives procedure by calling another shareholders’ meeting to seek shareholders’ approval, with full allotment information provided for the shareholders' consideration.

According to the conditions of general mandate capital increase, the allocation to non-existing shareholders (PO and PP) cannot exceed 20% of paid-up capital, hence the maximum dilution effect will be 20% of paid-up capital

The company does not need to hold a shareholders’ meeting to approve capital increase every time it requires funds because shareholders have already approved the capital increase limit for each type of allotment type in advance, allowing the board of directors to carry out the allotment as appropriate.