ESOP: Employee Stock Option Program

An offer for sale of securities to directors or employees

An offer of securities to directors or employees can be done through the following three options:

- ESOP – Common Stock

- ESOP - Warrant

- Convertible Debenture : CD

An offer of securities to directors or employees can be done through the following three options:

- ESOP – Common Stock

- ESOP - Warrant

- Convertible Debenture : CD

Directors or Employees refer to:

- Board members of the company or its subsidiary who issues and offers ESOP

- Employees who agree to work for the company who issues and offers ESOP or for its subsidiary under an employment e.g. receiving salary, wages, or other forms of compensation

Benefits of ESOP

| Create work motivation by building a sense of ownership in the company or by providing returns for the performance of the work |

| Effectively increase business productivity and profits |

| Ensure sustainable business growth |

| Enjoy long-term and consistent returns while the business grows |

The differences between ESOP and EJIP

| ESOP | EJIP | |

| Approval to commence the program | The board of directors must propose the program to the shareholders' meeting for approval according to the conditions set out by the SEC | The board of directors can approve the program except in case there are directors participating in the program where the approval from the shareholders' meeting is required |

| Forms of returns | Shares or warrants Capital gain and dividends (if any) | Contribution by the company for the purchase of company’s shares Capital gains and dividends (if any) |

| Impacts on shareholders | Possibility of the dilution effect | No dilution effect. There may be a negative impact on the company's profits but this can be offset in the long run with the improved performance which will result in more stable share prices. |

| Offering period | As specified in the program | |

Taxation

- According to Section 39 of the Revenue Code, ESOP participants are deemed to have received assessable income, which must be included in the annual personal income tax calculation

- ESOP participants are taxed if there are capital gains from a difference between the exercise price and the market price (calculated on the average price in the month the shares are acquired)

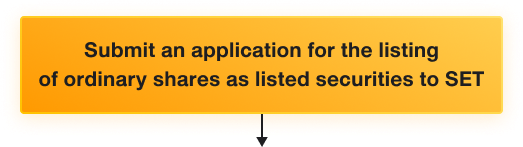

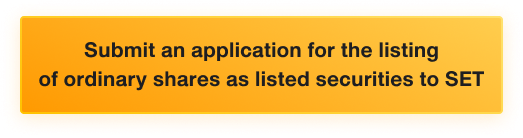

Disclose the resolution immediately or no later than 9 a.m. of the following business day (Capital Increase Report Form F53-4)

Disclose the resolution immediately or no later than 9 a.m. of the following business day (Capital Increase Report Form F53-4)

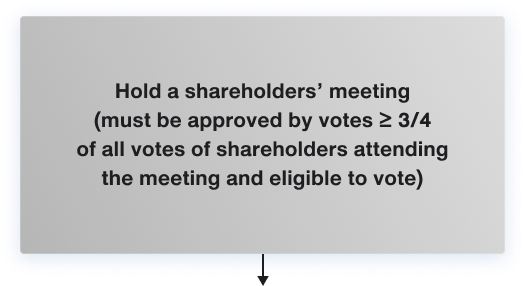

- Send notice of shareholders’ meeting at least 14 days in advance before the meeting date.

- For a general case:

veto from shareholders is no more than 10% of the total votes of shareholders attending the meeting and eligible to vote

- For special cases:

1. veto from shareholders is no more than 5% of the total votes of shareholders attending the meeting and eligible to vote

2. In case of concentrated allocation, each allocation to shareholder must be approved by votes of ≥ 3/4 of the total votes of shareholders attending the meeting and eligible to vote and veto from shareholders is no more than 5% of the total votes of shareholders

attending the meeting and eligible to vote. It also needs to be approved by the Renumeration Committee.

- Send notice of shareholders’ meeting at least 14 days in advance before the meeting date.

- For a general case:

veto from shareholders is no more than 10% of the total votes of shareholders

attending the meeting and eligible to vote

- For special cases:

1. veto from shareholders is no more than 5% of the total votes of shareholders attending

the meeting and eligible to vote

2. In case of concentrated allocation, each allocation to shareholder must be approved

by votes of ≥ 3/4 of the total votes of shareholders attending the meeting and eligible

to vote and veto from shareholders is no more than 5% of the total votes of shareholders

attending the meeting and eligible to vote. It also needs to be approved

by the Renumeration Committee.

Register change of capital ≤ 14 days since the date on which the shareholders’ meeting passes the resolution

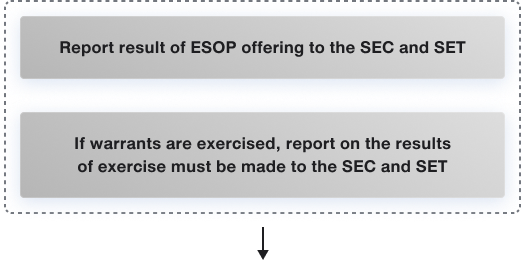

- Submit Form 53-5 to the SET ≤ 14 days since the date of closure of the offer for sale

- Submit Form 81-1 along with a checklist to the SEC ≤ 15 days since the date of closure of the offer for sale

- Report the exercise results to the SET ≤ 14 days since the date of closure of the offer for sale

- Submit Form 81-1 to report the exercise results within 15 days since the expiration of each exercise or the end of each month

≤ 30 days since the date of closure of the offer for sale

≤ 30 days since the date of closure of the offer for sale

≤ 2 days since the date the SET announces for the shares to be listed

≤ 2 days since the date the SET announces for the shares to be listed

≤ 30 days of every six calendar months

≤ 30 days of every six calendar months

|

|

|

Characteristics of an ESOP program

A general case refers to one of the following:

- Offer ≤ 5% of the total number of shares on the date the ESOP is approved by shareholders

- Offer > 5% of the total number of shares on the date the ESOP is approved by shareholders, with an offering price no more than 10% below the market price

Special case

Offer > 5% of the paid-up capital as of the date the ESOP is approved by shareholders, with an offering price that is more than 10% below the market

Concentrated allocation

An allocation to any one person more than 5% of the approved number of shares

Effects on existing shareholders

Issuing an ESOP has a dilution effect on existing shareholders due to capital increase

Effects on existing shareholders

Issuing an ESOP has a dilution effect on existing shareholders due to capital increase

Offer period

The securities must be offered until completion within 1 year after the program is approved by shareholders and the term of warrants cannot be longer than 5 years.

Approval conditions

Approval conditions

There is no need to submit an application for an offer for sale of newly issued shares under ESOP to the SEC but the company must meet the following requirements:

- It must comply with the ESOP rules

- It must obtain approval from the shareholders' meeting and the offer of securities must be completed within one year after the date of approval

- It must submit a checklist to the SEC with the report of the sale results within 15 days

Considering the impacts on financial statement

Considering by using Share-Based Payments (TFRS2: Share-Based Payment) under the Thai Financial Reporting Standard, 2nd Edition.

ESOP issued by a life insurance company

If the issuer is a life insurance company, the ESOP covers the company's licensed life insurance agents.