Disclosure rules

1. Periodic Information Disclosure

1.1) Information related to operating results and financial positions

| Required disclosure | Deadline* | Detail |

Annual financial statements (audited)

| Within 2 months Within 3 months | Required submission to SET:

|

| Quarterly financial statements (reviewed) | Within 45 days | |

| Form 56-REIT1 | Within 3 months | |

| Annual reports | Within 4 months |

* From the end of each accounting period. If the deadline falls on a non-business day, it shall be postponed to the next business day.

1.2) Other important information

| Required disclosure/submission | Disclosure/submission deadline |

| 1) Disclose as information for investors | |

| Asset values, net asset values and values of investment unit | Within 45 days from the end of each quarter* |

| Summaries of Q&A with unitholders during two-way communication sessions | Within 14 days from the completion date of each two-way communication session* |

| Progress reports on pre-completion Real estate projects under funds’ investment | Every 6 months from the date of investment in such principal assets. The reports shall be disclosed within 30 days from the end of the 6-month period* |

| 2) Submission to SET for information | |

| Notices of unitholder meetings or two-way communication sessions | Concurrent with the submission of the notices to the unitholders |

| Minutes of unitholder meetings | Within 14 days from the unitholder meetings |

* In accordance with the criteria prescribed under the SEC notifications

2. Material events disclosure

Examples of information to be disclosed:

| Required disclosure | Disclosure time frame |

| 2.1) Information related to fund operations or information potentially affecting trading prices of fund units, or investment decisions or benefits of unitholders | |

| Immediately |

| 2.2) Information not having direct impact but warranting disclosure to investors | |

| Within 3 working days |

| Within 14 days from BC or RD |

| 2.3) Disclosure of book closing dates (BC) or record dates (RD) | |

| ≥ 14 days prior to BC or RD |

| ≥ 7 days prior to BC or RD previously disclosed |

Methods of information disclosure and submission

- Disclosure and submission of information in both Thai and English must be made via SETPortal.

- For material information requiring immediate disclosure, such disclosure must be made without delay on the event date or, at the latest, before the first trading session on the next business day.

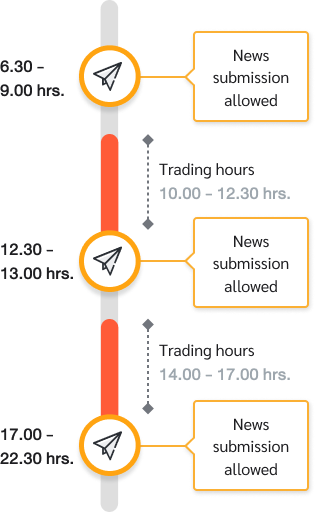

Time interval for information disclosure via SETPortal

Delisting rules

Examples of grounds for possible delisting:

- Investment units failing to meet any of the following requirements:

- Bearing holders’ names

- Having no restrictions on transfer of investment units

- Having SEC-approved fund schemes

- Having SEC-approved fund managers

- Management companies demonstrate violation of or non-compliance with SET’s regulations which may severely affect the rights and benefits of investors, investor decisions, or investment unit price movement.

- Management companies disclose false information or omit disclosure of material information which may severely affect the rights and benefits of investors, investor decisions, or investment unit price movement.

- Trading in the investment units has been suspended (SP designation) for more than 2 consecutive years due to funds’ violation of or non-compliance with SET’s regulations.

- Auditor’s disclaimer of opinion on the annual financial statements for 3 consecutive years.

- Mutual funds reach their maturity.

- Mutual funds dissolve on grounds prescribed under the SEC notifications.

Related Regulations

|

|

|

Related informations