The Stock Exchange of Thailand (SET) has issued guidelines on the supervision of real estate investment trusts (REITs), property funds, and infrastructure funds (collectively referred to as the “Funds”). Under these guidelines, caution signs will be designated to the Funds in order to alert investors about the Funds’ heightened risk profiles, events that may affect the financial positions, business operations, or liquidity status of the Funds, and the Funds’ violation of or non-compliance with SET’s regulations. In such circumstances, purchases of such funds can be made through cash balance accounts only.

The criteria for issuing caution signs which comprise of “CB” (Business), “CS” (Financial Statements), “CC” (Non-compliance), and “CF” (Free Float) are as summarized below.

Caution sign issuance criteria

| Sign | Sign issuance | Sign removal |

|---|---|---|

| CB (Business) |

|

|

|

| |

|

| |

|

| |

| CS (Financial Statements) |

|

|

|

| |

| CC (Non-compliance) | The fund is in the process of rectifying fund dissolution causes as specified by the SEC, such as: | The fund has rectified the dissolution causes, such as: |

|

| |

|

| |

| CF (Free Float) | Applicable only to trusts and infrastructure funds (IFFs): | |

|

| |

|

|

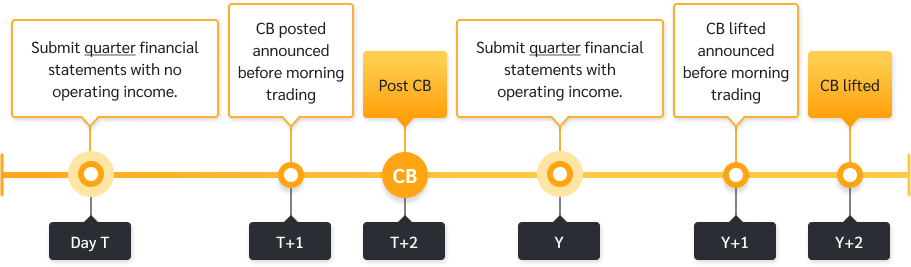

1/ Operating income refers to recurring income generated on a consistent basis that reflects the fund’s ability to sustain its core business operations. This is assessed on a quarterly basis.

2/ This refers to any of the following events:

| Default on debt payment / failure to fulfill obligations | |

|---|---|

| Case 1: Financial institution debts | Upon receipt of a notice of debt repayment demand from a financial institution |

| Case 2: Debt instruments | Based on the signs issued by the bond information center (currently the Thai Bond Market Association or ThaiBMA), such as DP (Default Payment), DNP (Default Not Related to Payment), FP (Fail to Pay), FPG (Failed to Pay with Guarantee). |

| Case 3: Non-financial institution debt or failure to comply with legal obligations related to financial assistance | Where the defaulted amount is at 5% of the fund’s total asset value or higher. |

Procedures to be undertaken by funds marked with CB, CS, CC, and CF

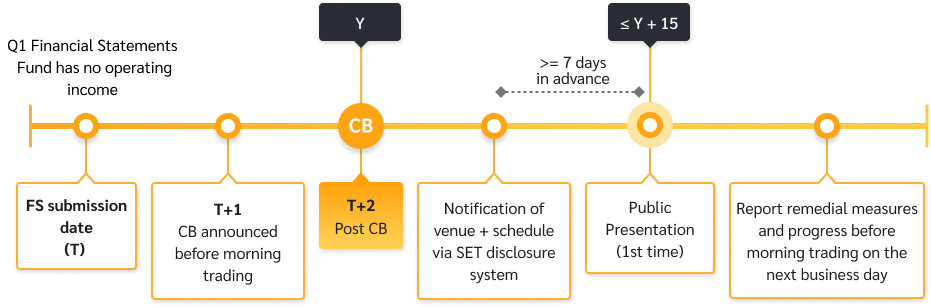

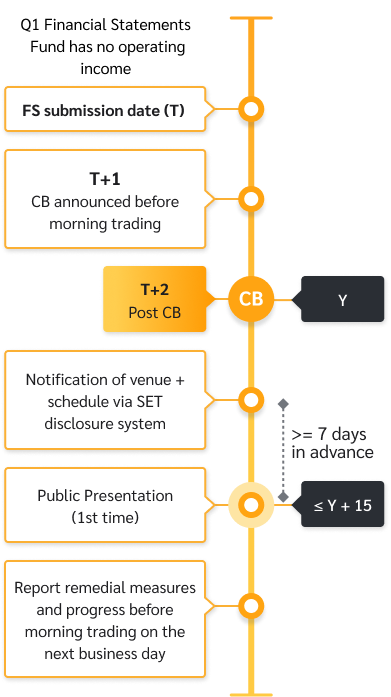

Such funds are required to hold a public presentation within 15 days from the date they are designated the CB, CS, CC, or CF signs by the Stock Exchange of Thailand (SET) to provide their remedial plans and progress updates on the resolution of the issues. Following this initial public presentation, the funds must hold public presentations on a quarterly basis to report progress updates. The determination of each quarterly public presentation date shall be based on the funds’ submission of their financial statements or the deadline for the submission of financial statements, whichever is earlier.

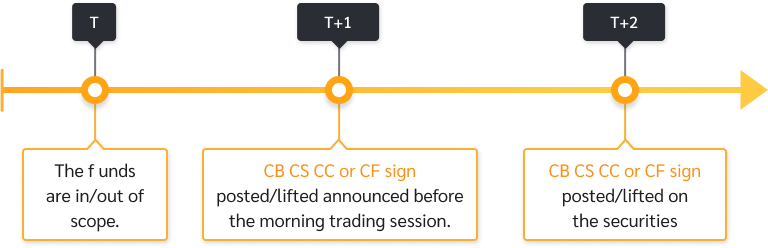

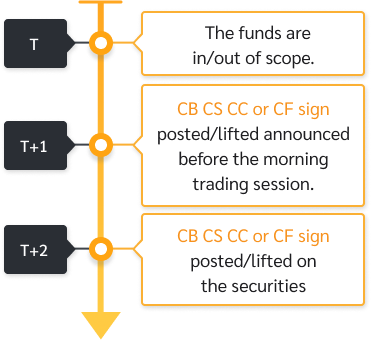

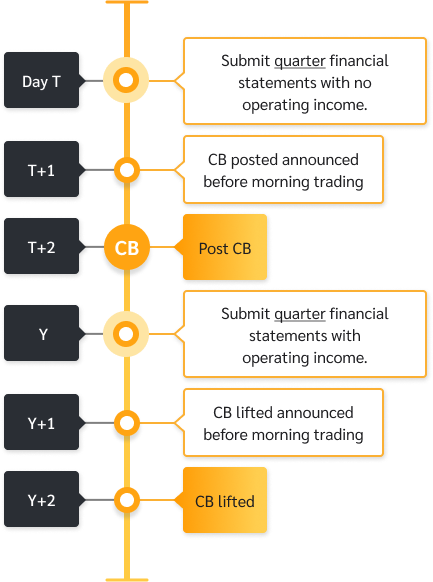

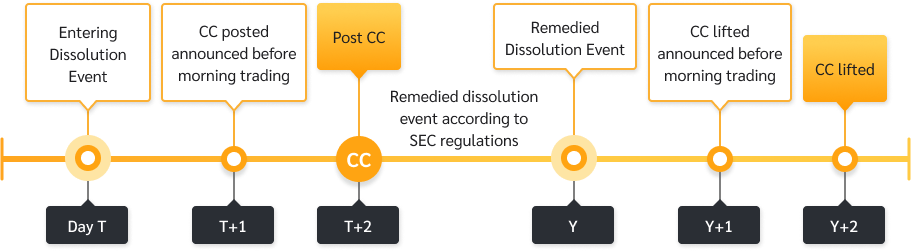

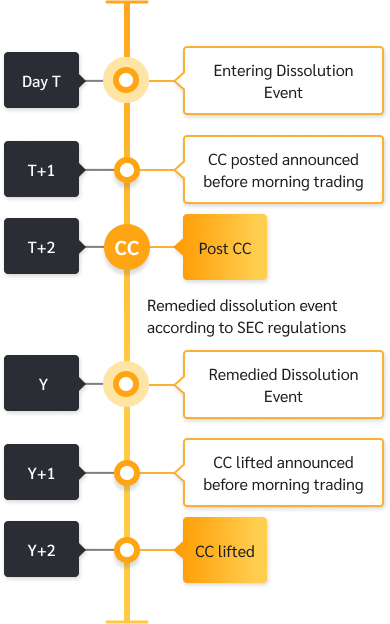

Procedures for caution sign designation

Upon the availability of information confirming that the funds meet CB, CS, CC, or CF designation criteria, SET will announce the designation of such caution signs on the next trading day before the commencement of the morning session. Effective from the business day following such announcement, all purchases of such funds must be executed through cash balance accounts only.

Once the funds have successfully resolved such issues or the funds are announced as being subject to possible delisting, their CB, CS, CC, or CF signs will be lifted and the announcement of the sign removal will be announced by SET one business day in advance.

Q&As

FAQ: Caution Signs for Fund Supervision

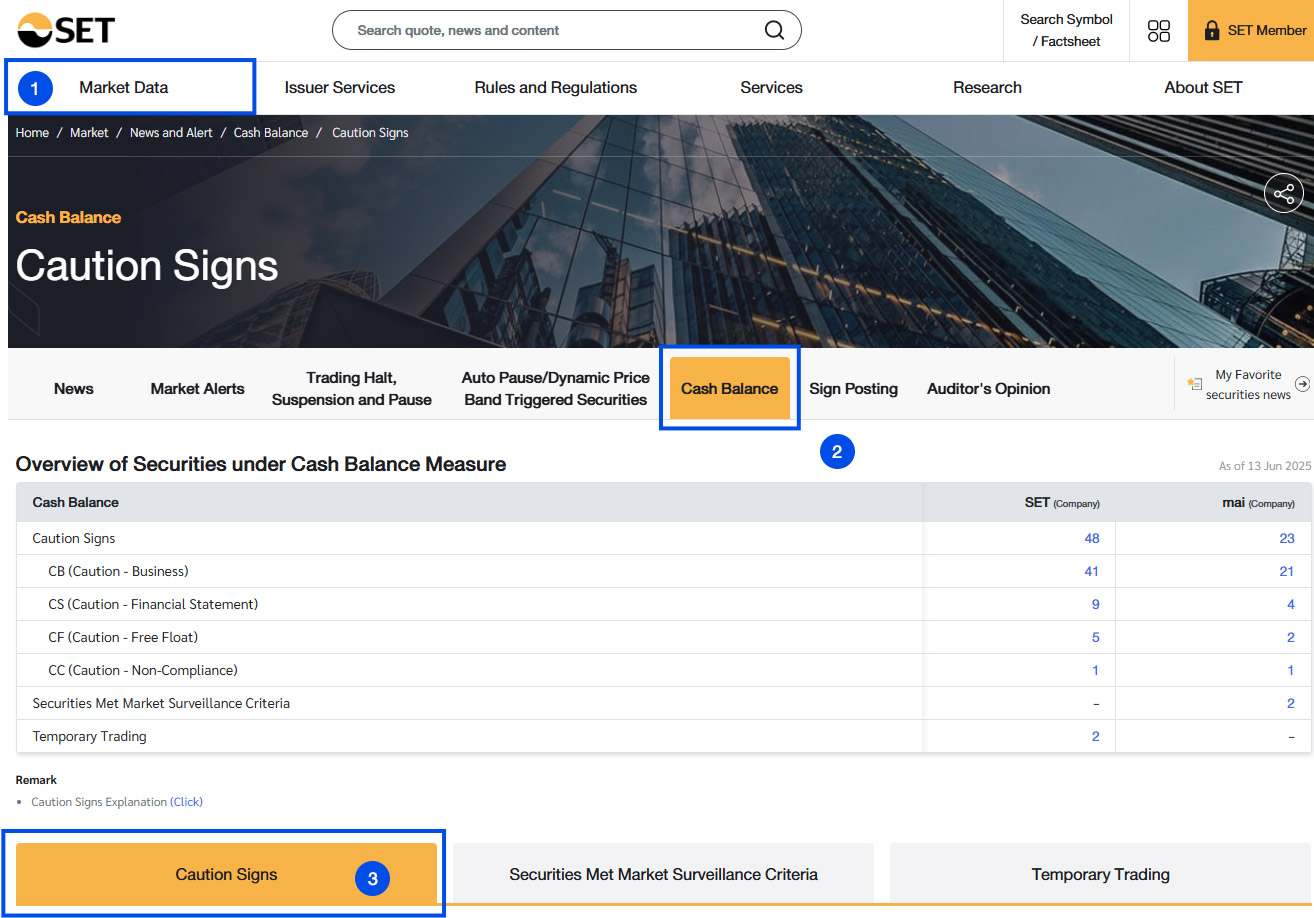

All users can track the list of such funds through the SET's information disclosure system as follows:

1) https://www.set.or.th/en/home under the topic "Market Data" >> "News and Market Alerts" >> "Cash Balance" >> "Caution Signs" (click here)

2) www.setsmart.com under the topic "News" >> "Securities Met C (Caution) Sign Criteria

It comes into effect on January 1, 2025. If the reason refers to information in the financial statements, the SET will start considering financial statements that are due after the effective date of the regulation.

Once the SET assigns a Caution sign (CB, CF, CS, and CC), investors must buy trust units or investment units with full cash in a cash balance account.

The fund must organize a meeting to provide information and explain the remedial measures for the situation to unitholders, investors, and other relevant parties. This meeting must also provide an opportunity for them to ask questions of the fund (Public Presentation) within 15 days from the date the sign is assigned. Such a meeting must also be held every quarter to report progress. Additionally, the fund must report the action plan and progress through the SET's information disclosure system.

The remedial measures and progress reports must be approved by the management company and the trustee (for real estate investment trusts and infrastructure funds) or the trust manager and trustee (for trusts).

Example

Note : For Public Presentations due to other Caution signs, the same example above applies. If a fund has more than one Caution sign, the first Public Presentation must be arranged separately for each reason. Subsequent quarterly Public Presentations can be combined.

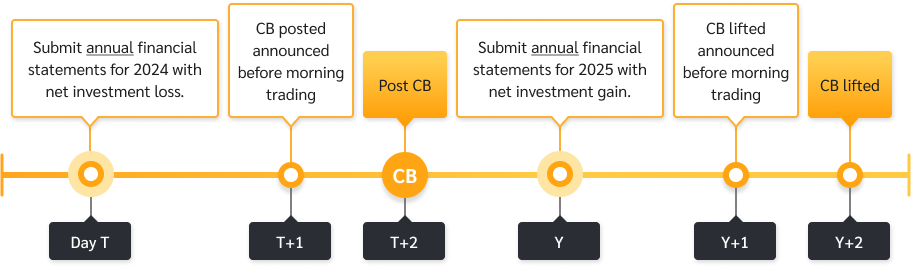

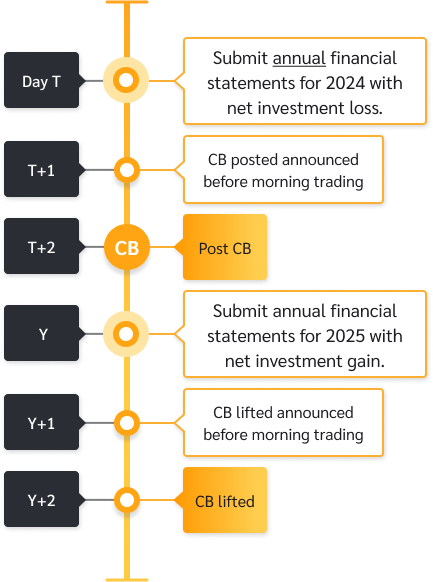

It is assessed based on the net investment gain/loss appearing in the income statement. The SET will assign a CB sign when the fund has a net investment loss, which appears in the annual financial statements.

The SET will lift the CB sign only when the fund has a net investment gain, which appears in the annual financial statements submitted after the CB sign was assigned.

Example

CB Sign (Business)

Operating income refers to income that is regular, continuous, and reflects the fund's ability to operate its core business consistently. The assessment of operating income may vary depending on the type of assets the fund invests in. The SET assigns and lifts the sign based on the latest financial statements.

Example| Asset Type Invested In | Example of Operating Income |

|---|---|

| 1. Ownership and/or Leasehold Rights | - Rental income - Rental and service income |

| 2. Right to receive future benefits or contractual rights to future income of infrastructure businesses | - Income from investments in asset transfer and income rights agreements - Interest income - Income from investments in net income right transfer agreements |

CS Sign (Financial Statements)

The auditor's disclaimer of opinion on quarterly financial statements or refusal to express an opinion on annual financial statements in all cases (both due to scope limitation by circumstances and scope limitation by the fund or parties involved in the fund's management).

The auditor must express an unqualified or qualified opinion on the next period's financial statements.

The fund will be assigned an SP (Suspension) sign for 1 day to allow investors sufficient time to study the information for investment decisions, and a CS sign will be assigned until the fund submits financial statements with an unqualified or qualified opinion from the auditor.

If the auditor disclaims an opinion on the fund's annual financial statements for 3 consecutive years, the SET will announce that the fund's securities may be delisted and will assign NC, SP signs, and lift the CS sign.

CC Sign (Non-Compliance)

If a fund meets the criteria for dissolution according to SEC regulations , such as when the fund disposes of core assets to a value below the SEC's specified threshold, or if the fund has fewer than 35 unitholders, etc., the fund must disclose information through the SET's information disclosure system. The SET will assign a CC sign on the next business day following the news announcement and will lift the sign only when the fund discloses news that it has remedied the dissolution event according to SEC regulations.

CF Sign (Free Float)

Trusts and Infrastructure Funds are required to submit a Free Float report within 120 days from the end of the fund's accounting period.

If a Trust or Infrastructure Fund has less than 15% retail unitholders of the total units, or if it fails to submit the retail unitholder distribution report within the specified time, the SET will announce the assignment of a CF sign on the first business day of the month following the report submission deadline.

When the fund resolves the Free Float issue, resulting in retail unitholders being >= 15% of the total units, the fund can close its register to prepare and submit the retail unitholder distribution report to the SET and request the SET to lift the CF sign, without having to wait for the next annual report submission cycle.

ตัวอย่าง

Related informations